Question: the presvious page is other question Section 2 Structural short questions (Total 70 points) The following questions concern Beta Inc., a hypothetical company in the

the presvious page is other question

the presvious page is other question

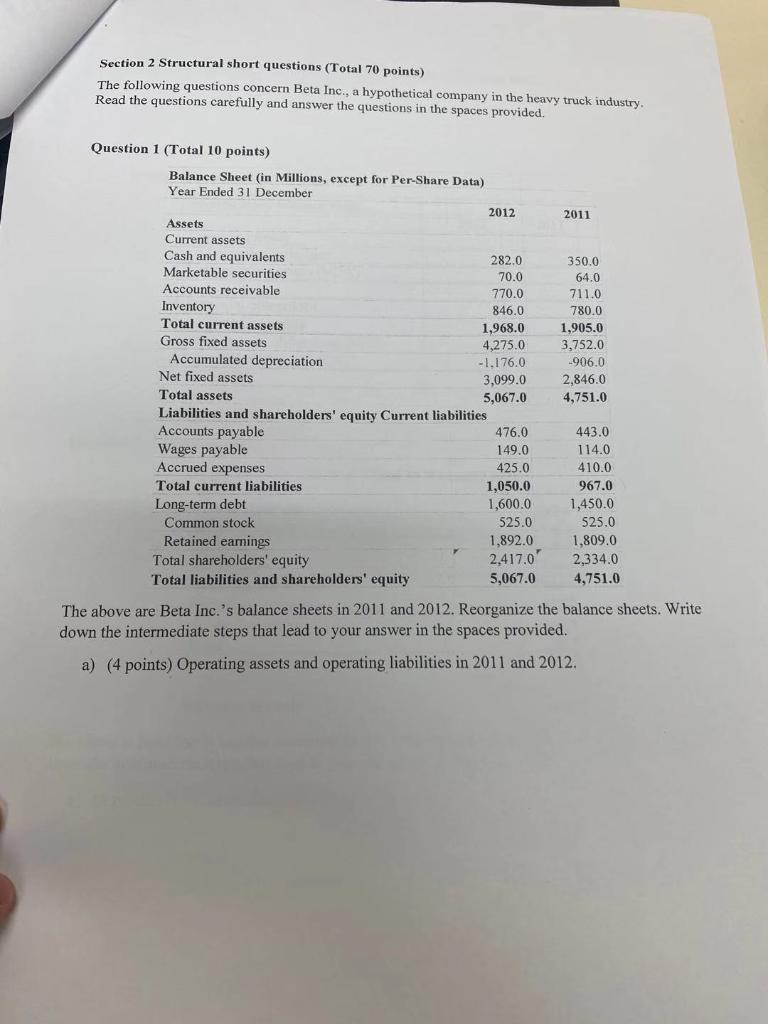

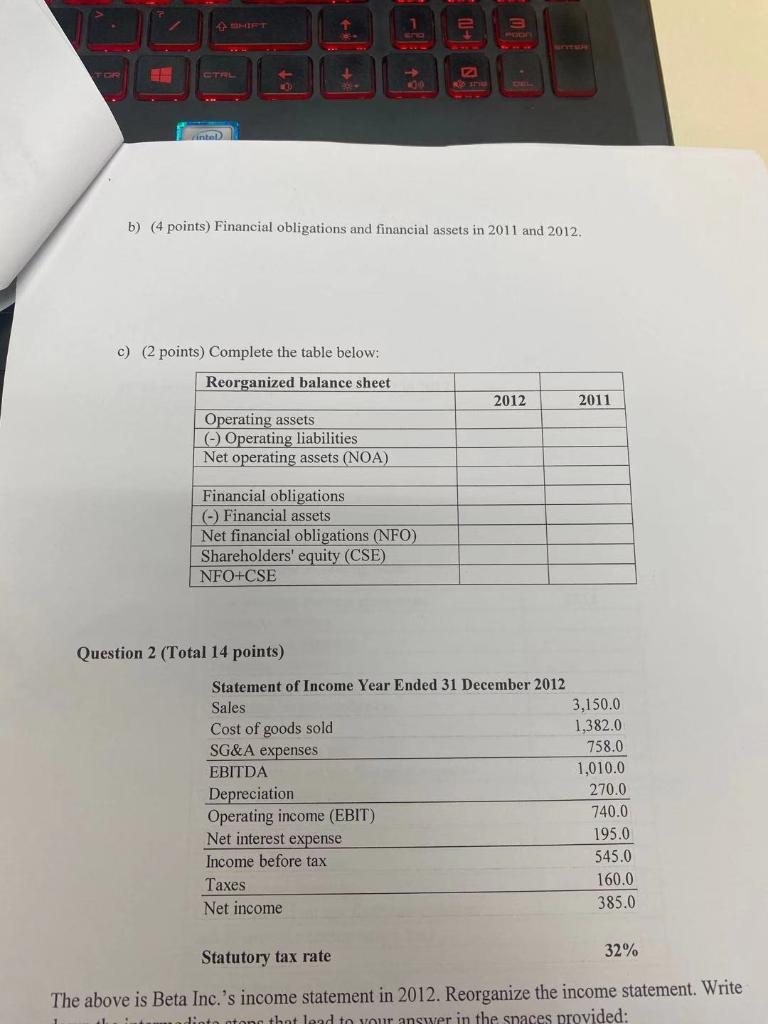

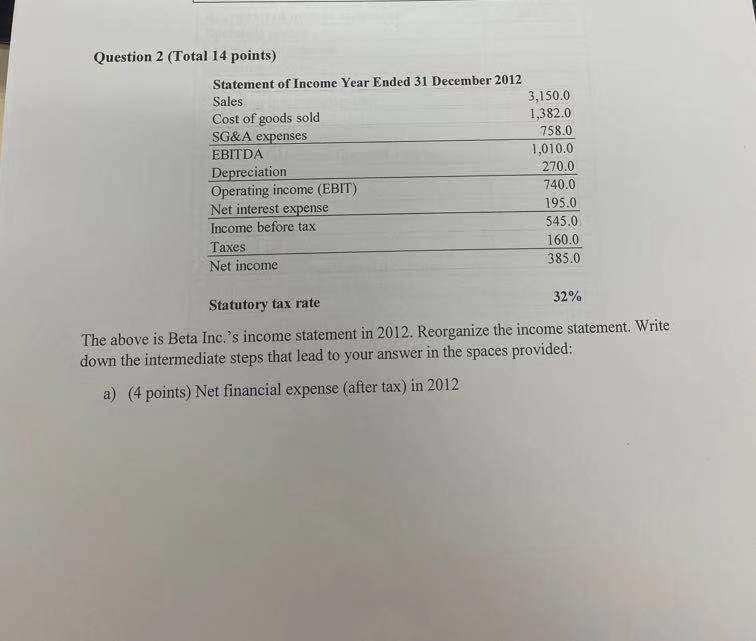

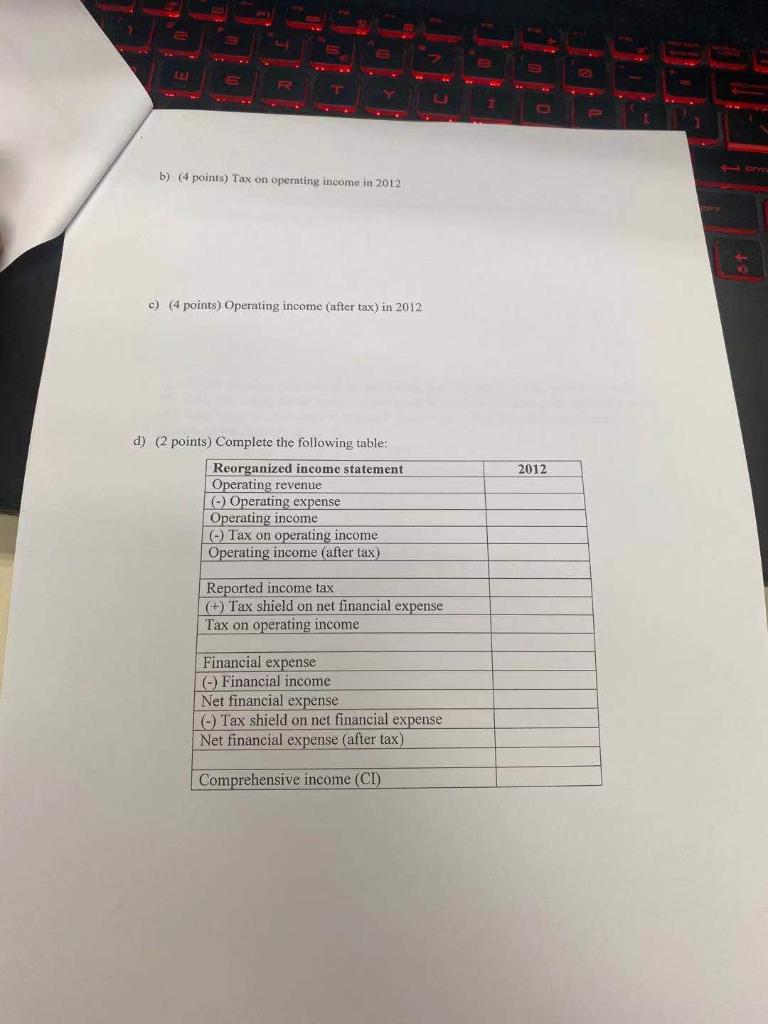

Section 2 Structural short questions (Total 70 points) The following questions concern Beta Inc., a hypothetical company in the heavy truck industry, Read the questions carefully and answer the questions in the spaces provided. Question 1 (Total 10 points) Balance Sheet (in Millions, except for Per-Share Data) Year Ended 31 December 2012 2011 Assets 350.0 64.0 711.0 780.0 1,905.0 3,752.0 -906.0 2,846.0 4,751.0 Current assets Cash and equivalents 282.0 Marketable securities 70.0 Accounts receivable 770.0 Inventory 846.0 Total current assets 1,968.0 Gross fixed assets 4,275.0 Accumulated depreciation - 1.176.0 Net fixed assets 3,099.0 Total assets 5,067.0 Liabilities and shareholders' equity Current liabilities Accounts payable 476.0 Wages payable 149.0 Accrued expenses 425.0 Total current liabilities 1,050.0 Long-term debt 1,600.0 Common stock 525.0 Retained eamings 1,892.0 Total shareholders' equity Total liabilities and shareholders' equity 5,067.0 443.0 114.0 410.0 967.0 1,450.0 525.0 1,809.0 2,334.0 4,751.0 2,417.0" The above are Beta Inc.'s balance sheets in 2011 and 2012. Reorganize the balance sheets. Write down the intermediate steps that lead to your answer in the spaces provided. a) (4 points) Operating assets and operating liabilities in 2011 and 2012. 1 2 00 . Tantot b) (4 points) Financial obligations and financial assets in 2011 and 2012 c) (2 points) Complete the table below: Reorganized balance sheet 2012 2011 Operating assets Operating liabilities Net operating assets (NOA) Financial obligations - Financial assets Net financial obligations (NFO) Shareholders' equity (CSE) NFO+CSE Question 2 (Total 14 points) Statement of Income Year Ended 31 December 2012 Sales Cost of goods sold SG&A expenses EBITDA Depreciation Operating income (EBIT) Net interest expense Income before tax Taxes Net income 3,150.0 1,382.0 758.0 1,010.0 270.0 740.0 195.0 545.0 160.0 385.0 32% Statutory tax rate The above is Beta Inc.'s income statement in 2012. Reorganize the income statement. Write dinta ton that lead to your answer in the spaces provided: Question 2 (Total 14 points) Statement of Income Year Ended 31 December 2012 Sales Cost of goods sold SG&A expenses EBITDA Depreciation Operating income (EBIT) Net interest expense Income before tax Taxes Net income 3,150.0 1,382.0 758.0 1,010.0 270.0 740.0 195.0 545.0 160.0 385.0 Statutory tax rate 32% The above is Beta Inc.'s income statement in 2012. Reorganize the income statement. Write down the intermediate steps that lead to your answer in the spaces provided: a) (4 points) Net financial expense (after tax) in 2012 R b) (4 points) Tax on operating income in 2012 c) (4 points) Operating income (after tax) in 2012 2012 d) (2 points) Complete the following table: Reorganized income statement Operating revenue LO) Operating expense Operating income (-) Tax on operating income Operating income (after tax) Reported income tax (+) Tax shield on net financial expense Tax on operating income Financial expense Financial income Net financial expense (-) Tax shield on net financial expense Net financial expense after tax) Comprehensive income (CI)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts