Question: The Problem: Alabasters is using a printing machine that was purchased prior to the Tax Cut and Jobs Act. It is being depreciated on a

The Problem: Alabasters is using a printing machine that was purchased prior to the Tax Cut and Jobs Act. It is being depreciated on a straight-line basis, and it has 6 years of life remaining. The book value currently is $2,100, and it can be sold for $2,500 at this time. Thus, its annual depreciation expense is $2,100/6=$350 per year. If this machine is not replaced, it can be sold for $500 at the end of its useful life.

Alabasters can purchase a replacement machine which has a cost of $8,000, an estimated useful life of 6 years, and an estimated salvage value of $800. This replacement machine is eligible for 100% bonus depreciation at the time of purchase. The new machine would permit an output expansion, so annual sales would rise by $1,000 per year; even so, the replacement machines greater efficiency would cause operating expenses to decline by $1,500 per year. The replacement machine would require that inventories be increased by $2,000 but accounts payable would simultaneously increase by $500. Alabaster's marginal federal-plus-state tax rate is 25%, and its WACC is 11%.

Should it replace the old machine? Upon what are you basing this decision?

Show all work to receive full credit and follow the model in section 12-2

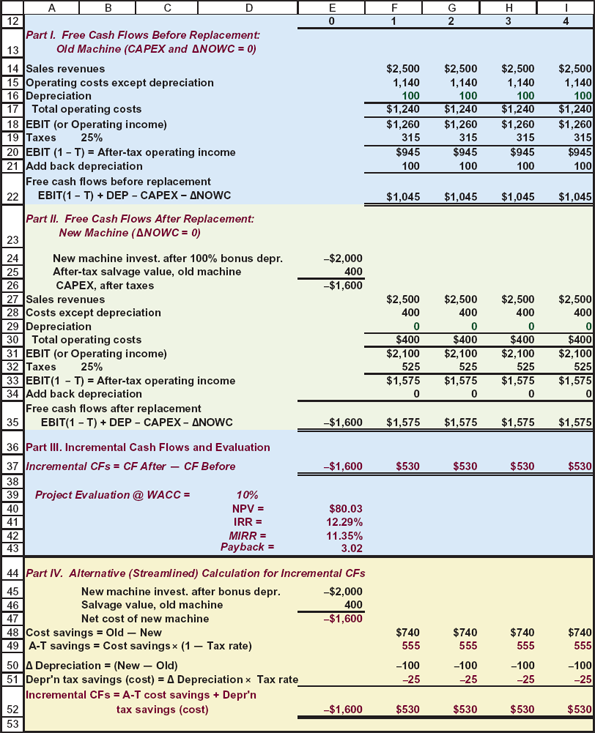

Here is an example of the template in section 12-2

D E 0 F 1 UN G 2 H 3 4 17 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 - $1,045 $1,045 $1,045 $1,045 A 12 Part I. Free Cash Flows Before Replacement: 13 Old Machine (CAPEX and ANOWC = 0) 14 Sales revenues 15 Operating costs except depreciation 16 Depreciation Total operating costs 18 EBIT (or Operating income) 19 Taxes 25% 20 EBIT (1 - 1) = After-tax operating income 21 Add back depreciation Free cash flows before replacement 22 EBIT(1 - T) + DEP - CAPEX - ANOWC Part II. Free Cash Flows After Replacement: 23 New Machine (ANOWC = 0) 24 New machine invest. after 100% bonus depr. $2,000 25 After-tax salvage value, old machine 400 26 CAPEX, after taxes -$1,600 27 Sales revenues 28 Costs except depreciation 29 Depreciation 30 Total operating costs 31 EBIT (or Operating income) 32 Taxes 25% 33 EBIT(1 - T) = After-tax operating income 34 Add back depreciation Free cash flows after replacement 35 EBIT(1 - T) + DEP - CAPEX - ANOWC $1,600 36 Part III. Incremental Cash Flows and Evaluation 37 incremental CFs = CF After - CF Before $1,600 38 39 Project Evaluation @ WACC = 10% 40 NPV = $80.03 41 IRR = 12.29% 42 MIRR = 11.35% 43 Payback = 3.02 44 Part IV. Alternative (Streamlined) Calculation for Incremental CFS 45 New machine invest. after bonus depr. $2,000 46 Salvage value, old machine 400 47 Net cost of new machine $1,600 48 Cost savings = Old New 49 A-T savings = cost savings x (1 Tax rate) 50 Depreciation = (New Old) 51 Depr'n tax savings (cost) = A Depreciation Tax rate Incremental CFs = A-T cost savings + Depr'n 52 tax savings (cost) $1,600 53 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $1,575 $1,575 $1,575 $1,575 $530 $530 $530 $530 $740 555 $740 555 $740 555 $740 555 -100 -25 -100 -25 -100 -25 -100 -25 $530 $530 $530 $530 D E 0 F 1 UN G 2 H 3 4 17 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 $2,500 1,140 100 $1,240 $1,260 315 $945 100 - $1,045 $1,045 $1,045 $1,045 A 12 Part I. Free Cash Flows Before Replacement: 13 Old Machine (CAPEX and ANOWC = 0) 14 Sales revenues 15 Operating costs except depreciation 16 Depreciation Total operating costs 18 EBIT (or Operating income) 19 Taxes 25% 20 EBIT (1 - 1) = After-tax operating income 21 Add back depreciation Free cash flows before replacement 22 EBIT(1 - T) + DEP - CAPEX - ANOWC Part II. Free Cash Flows After Replacement: 23 New Machine (ANOWC = 0) 24 New machine invest. after 100% bonus depr. $2,000 25 After-tax salvage value, old machine 400 26 CAPEX, after taxes -$1,600 27 Sales revenues 28 Costs except depreciation 29 Depreciation 30 Total operating costs 31 EBIT (or Operating income) 32 Taxes 25% 33 EBIT(1 - T) = After-tax operating income 34 Add back depreciation Free cash flows after replacement 35 EBIT(1 - T) + DEP - CAPEX - ANOWC $1,600 36 Part III. Incremental Cash Flows and Evaluation 37 incremental CFs = CF After - CF Before $1,600 38 39 Project Evaluation @ WACC = 10% 40 NPV = $80.03 41 IRR = 12.29% 42 MIRR = 11.35% 43 Payback = 3.02 44 Part IV. Alternative (Streamlined) Calculation for Incremental CFS 45 New machine invest. after bonus depr. $2,000 46 Salvage value, old machine 400 47 Net cost of new machine $1,600 48 Cost savings = Old New 49 A-T savings = cost savings x (1 Tax rate) 50 Depreciation = (New Old) 51 Depr'n tax savings (cost) = A Depreciation Tax rate Incremental CFs = A-T cost savings + Depr'n 52 tax savings (cost) $1,600 53 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $2,500 400 0 $400 $2,100 525 $1,575 0 $1,575 $1,575 $1,575 $1,575 $530 $530 $530 $530 $740 555 $740 555 $740 555 $740 555 -100 -25 -100 -25 -100 -25 -100 -25 $530 $530 $530 $530

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts