Question: The problem is Q6-1amd the question to answer is the photo from Q6-2 to Q6-9 and when you answer it also please do by photo

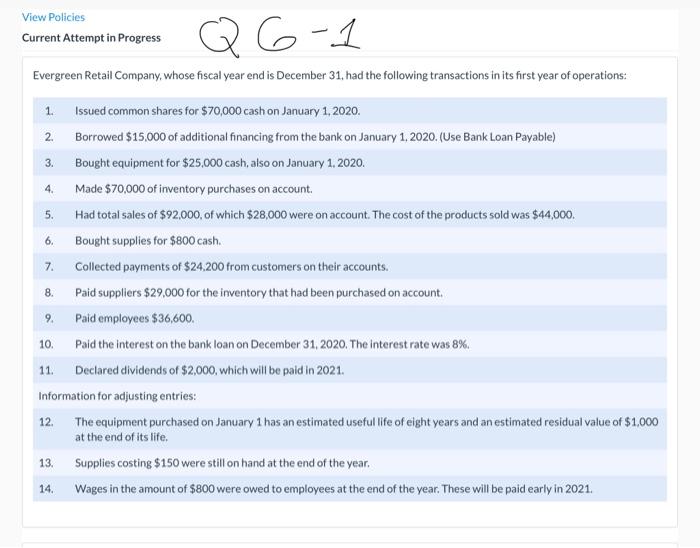

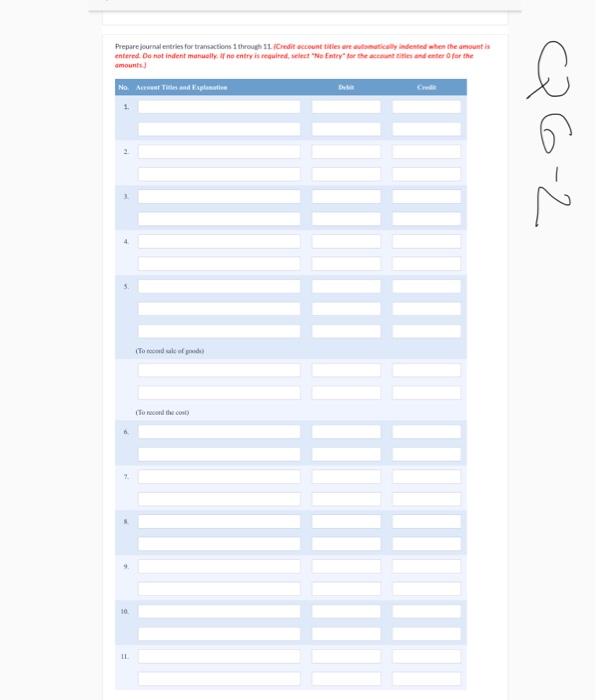

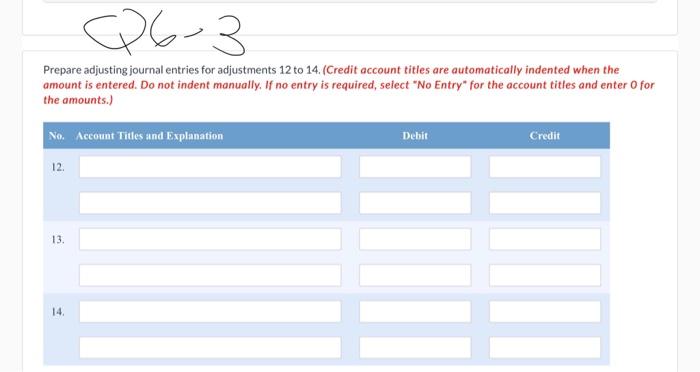

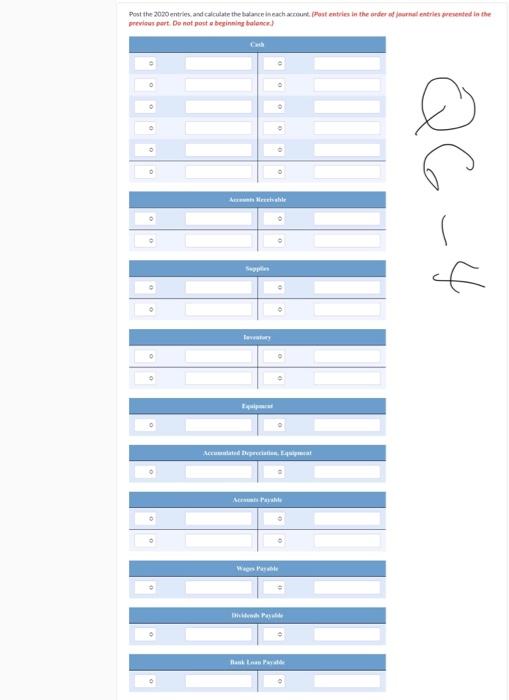

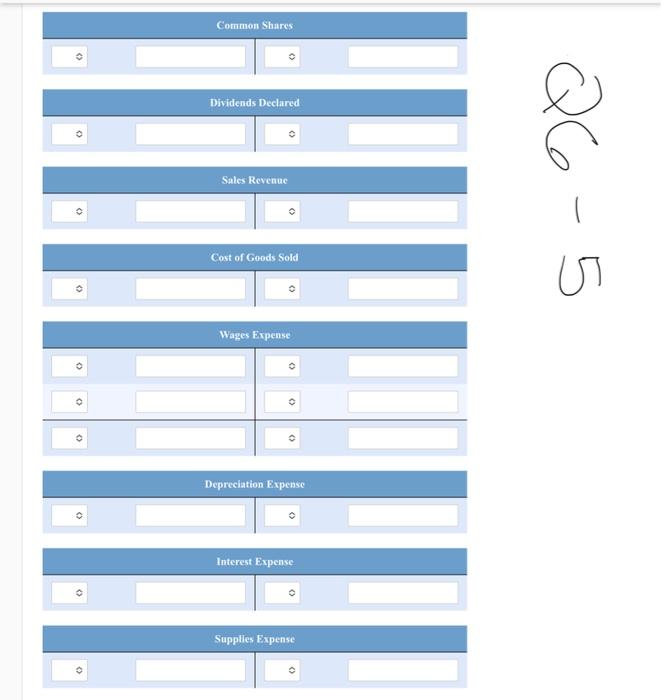

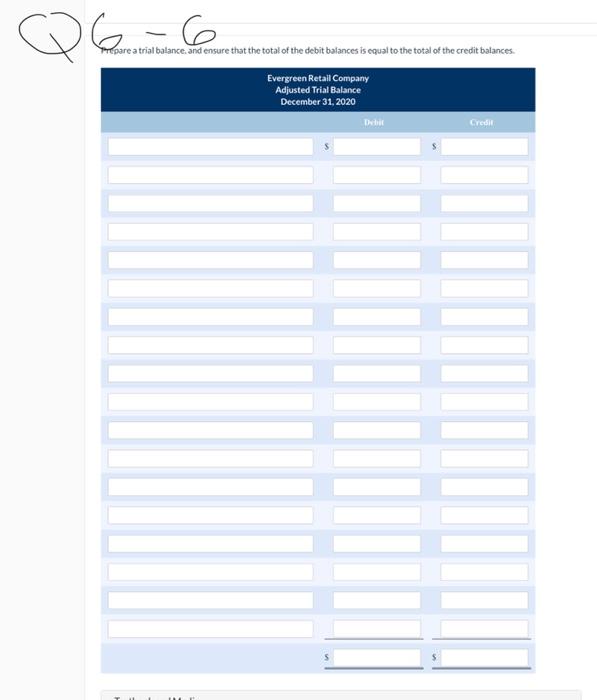

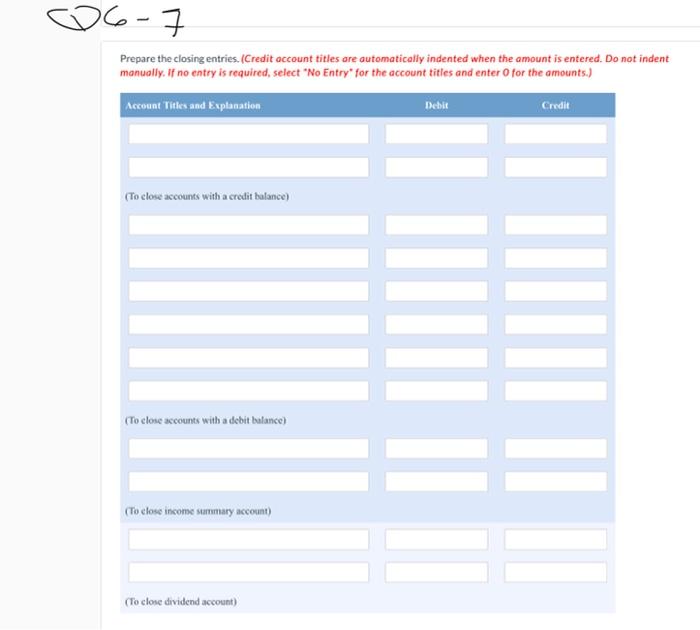

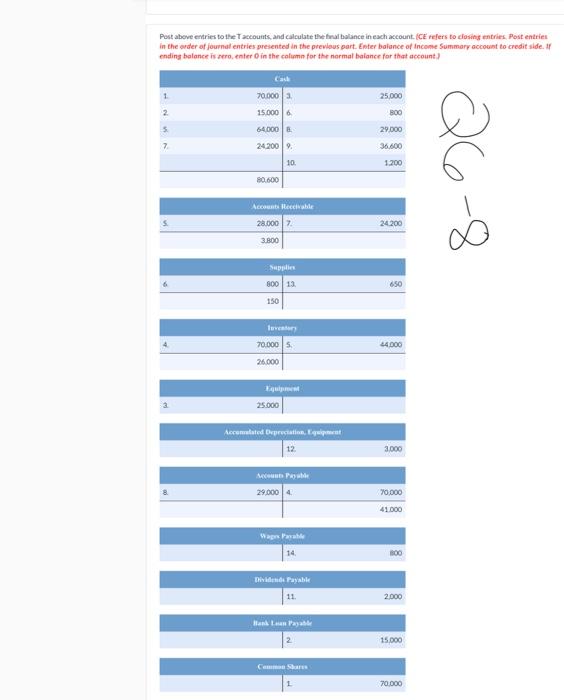

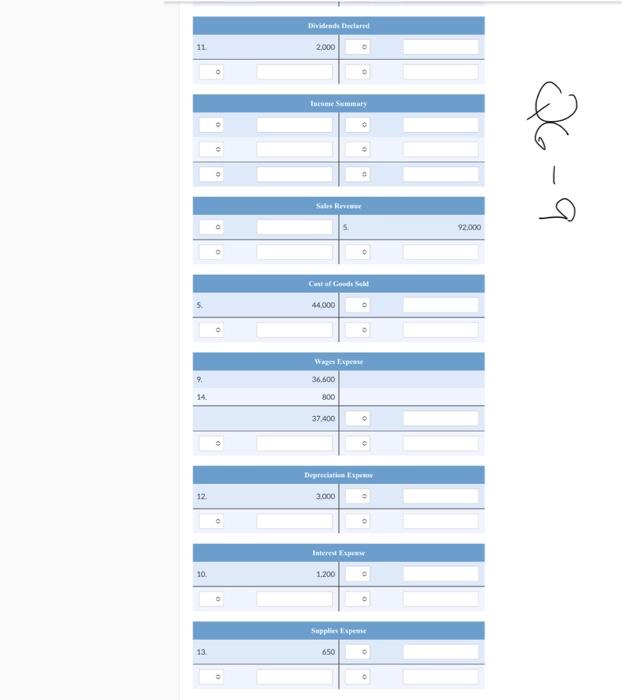

View Policies Current Attempt in Progress Q Q 6-1 Evergreen Retail Company, whose fiscal year end is December 31, had the following transactions in its first year of operations: 2. 3. 4. 5. 6. 8. 8. 1 Issued common shares for $70,000 cash on January 1, 2020. Borrowed $15,000 of additional financing from the bank on January 1, 2020. (Use Bank Loan Payable) Bought equipment for $25,000 cash, also on January 1, 2020. Made $70,000 of inventory purchases on account. Had total sales of $92,000, of which $28,000 were on account. The cost of the products sold was $44,000. Bought supplies for $800 cash. 7. Collected payments of $24.200 from customers on their accounts. Paid suppliers $29,000 for the inventory that had been purchased on account. 9. Paid employees $36,600 Paid the interest on the bank loan on December 31, 2020. The interest rate was 8%. 11. Declared dividends of $2,000, which will be paid in 2021. Information for adjusting entries: The equipment purchased on January 1 has an estimated useful life of eight years and an estimated residual value of $1,000 at the end of its life. Supplies costing $150 were still on hand at the end of the year. Wages in the amount of $800 were owed to employees at the end of the year. These will be paid early in 2021. 10. 12. 13 14. Prepare journal entries for transactions through 11 Credit Account titles article when the amount entered Do not indent mully, if no entry is required to Entendenter for the amounts No estos Espeti QG-2 (Toled (foncorde.com 10 11 06-3 Prepare adjusting journal entries for adjustments 12 to 14. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) No. Account Titles and Explanation Dehit Credit 12. 13 14 Post the 2020 entries and calculate the base in each court. (Post entries in the understal entries presented to the Previous part. Do not post beginning ble A sehr QC - | Tavaly td talen. Homputer thew Perhe flani na Common Shares Dividends Declared Q6 - 5 Sales Revenge Cost of Goods Sold Wages Expense o Depreciation Expense Interest Expense Supplies Expense Q6 6 6 repare a trial balance, and ensure that the total of the debit balances is equal to the total of the credit balances. Evergreen Retail Company Adjusted Trial Balance December 31, 2020 ht Credit 06- Prepare the closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To close accounts with a credit bulance) (To close accounts with a debit balance) (To close income summary account) (To close dividend account) Post above entries to the accounts, and calculate the final balance in each account. (CE refers to closing entries Post entries in the order of journal entries presented in the previous part. Enter balance of income Summary account to credit side. If ending balance is zero enter in the column for the normal balance for that account) 25.000 70.000 15.000 6 2 300 64.000 29.000 7 24200 36,600 1.200 10 80.600 Q6-8 Accounts Receivable 5 28.000 24200 3.800 Supplies 80013 650 150 Inventory 70.0005 84000 26.000 25.000 Accommodated Depreciation Equipment 12 3.000 Mean Paati | 29.000 4 70,000 41.000 aprawa 14 De Payable 11. 2.000 15.000 CS 70.000 Divide Dard 11 2.000 Income Summary Q6-9 Satrani 92.000 Cunt af Goods Sold 44.000 Wages Expo 36,600 9. 14. 800 37.400 Depreciation me 3.000 Interesse 10 1.200 Supplies Espesne 13 650 . o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts