Question: The problem requires the table be filled out for Years 0 1 2 and 3 please and thanks! Your company has been doing well, reaching

The problem requires the table be filled out for Years 0 1 2 and 3 please and thanks!

The problem requires the table be filled out for Years 0 1 2 and 3 please and thanks!

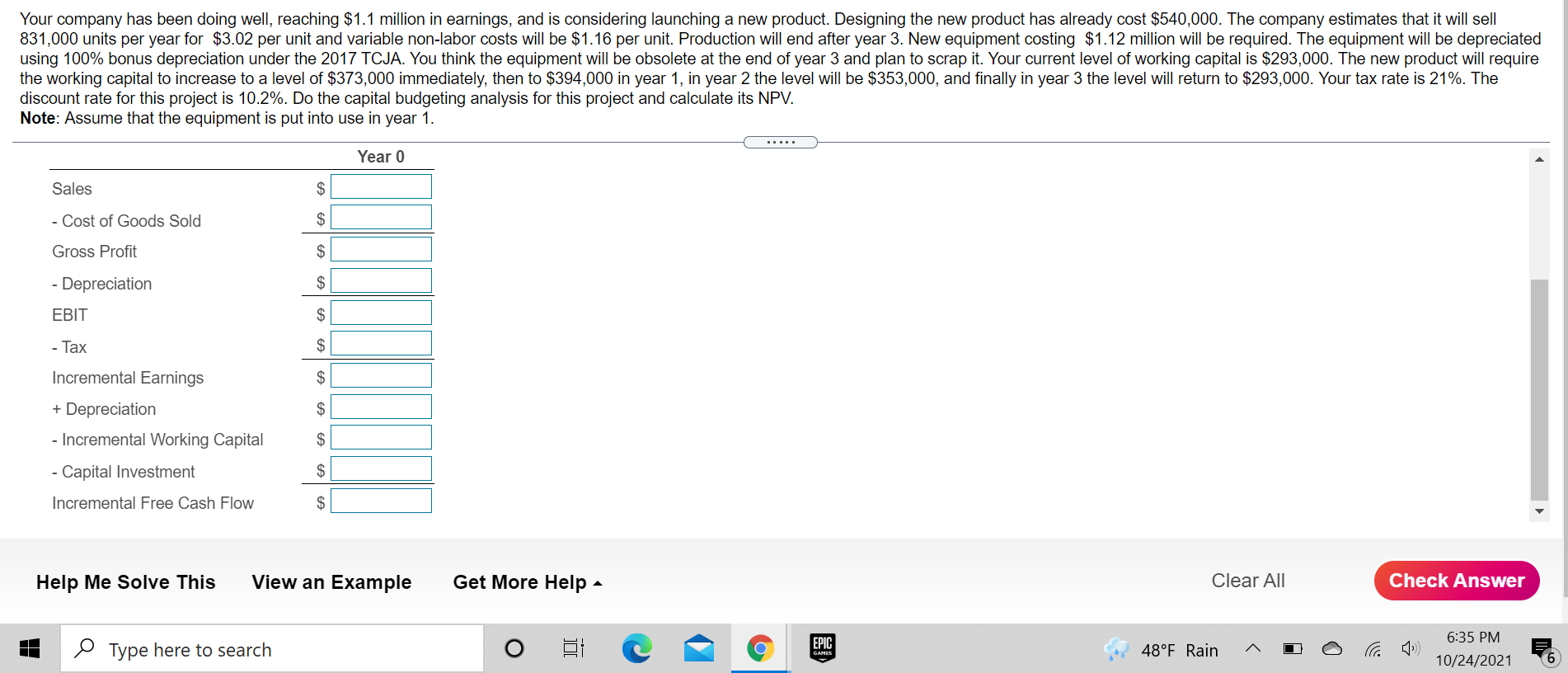

Your company has been doing well, reaching $1.1 million in earnings, and is considering launching a new product. Designing the new product has already cost $540,000. The company estimates that it will sell 831,000 units per year for $3.02 per unit and variable non-labor costs will be $1.16 per unit. Production will end after year 3. New equipment costing $1.12 million will be required. The equipment will be depreciated using 100% bonus depreciation under the 2017 TCJA. You think the equipment will be obsolete at the end of year 3 and plan to scrap it. Your current level of working capital is $293,000. The new product will require the working capital to increase to a level of $373,000 immediately, then to $394,000 in year 1, in year 2 the level will be $353,000, and finally in year 3 the level will return to $293,000. Your tax rate is 21%. The discount rate for this project is 10.2%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. Year o Sales $ - Cost of Goods Sold $ Gross Profit $ - Depreciation $ EBIT $ - Tax $ Incremental Earnings $ $ + Depreciation - Incremental Working Capital $ - Capital Investment $ Incremental Free Cash Flow $ Help Me Solve This View an Example Get More Help Clear All Check Answer O Type here to search EPIC GAMES 48F Rain 6:35 PM 10/24/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts