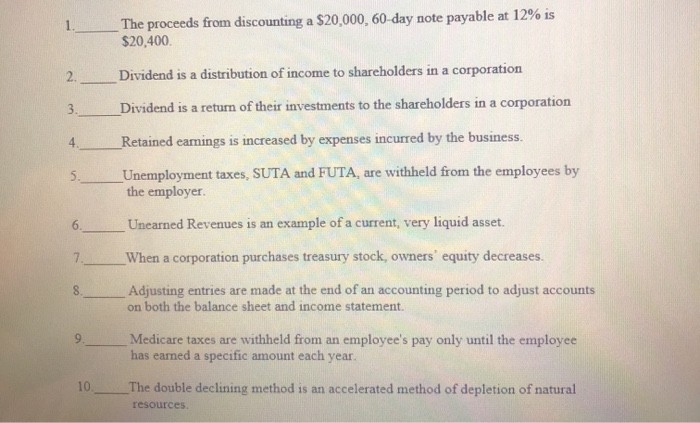

Question: The proceeds from discounting a $20,000, 60-day note payable at 12% is $20,400 Dividend is a distribution of income to shareholders in a corporation 3.

The proceeds from discounting a $20,000, 60-day note payable at 12% is $20,400 Dividend is a distribution of income to shareholders in a corporation 3. Dividend is a return of their investments to the shareholders in a corporation 4. Retained earnings is increased by expenses incurred by the business. Unemployment taxes, SUTA and FUTA, are withheld from the employees by the employer. Unearned Revenues is an example of a current, very liquid asset. When a corporation purchases treasury stock, owners' equity decreases. Adjusting entries are made at the end of an accounting period to adjust accounts on both the balance sheet and income statement. Medicare taxes are withheld from an employee's pay only until the employee has earned a specific amount each year. 10._ _The double declining method is an accelerated method of depletion of natural resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts