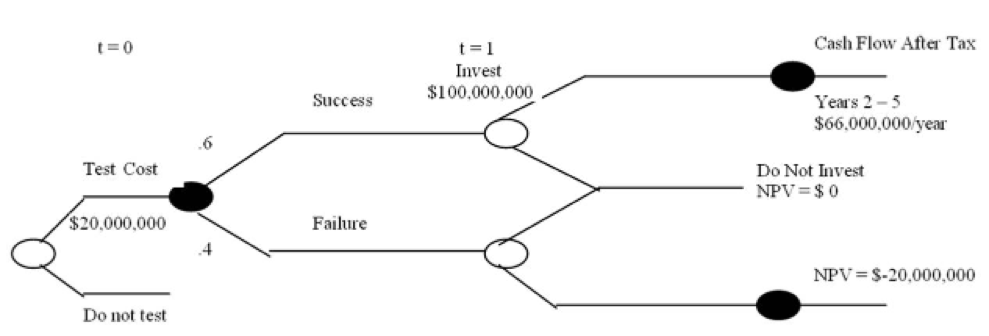

Question: The project defined by the following decision tree has a required discount rate of 15 percent. What is the Time 1 net present value of

The project defined by the following decision tree has a required discount rate of 15 percent.  What is the Time 1 net present value of a successful investment?

What is the Time 1 net present value of a successful investment?

$87,342,087

$122,008,054

$88,428,572

$112,997,143

$211,046,198

t=0 Cash Flow After Tay Invest $100,000.000 Success Years 2-5 $66,000,000 year .6 Test Cost Do Not Invest NPV = $ 0 $20,000,000 Failure NPV-S-20,000,000 Do not test

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts