Question: Question 3 Using the same spot rate curve as in question 2 above, construct an Excel spread sheet to calculate the at-the-money Swap Rate

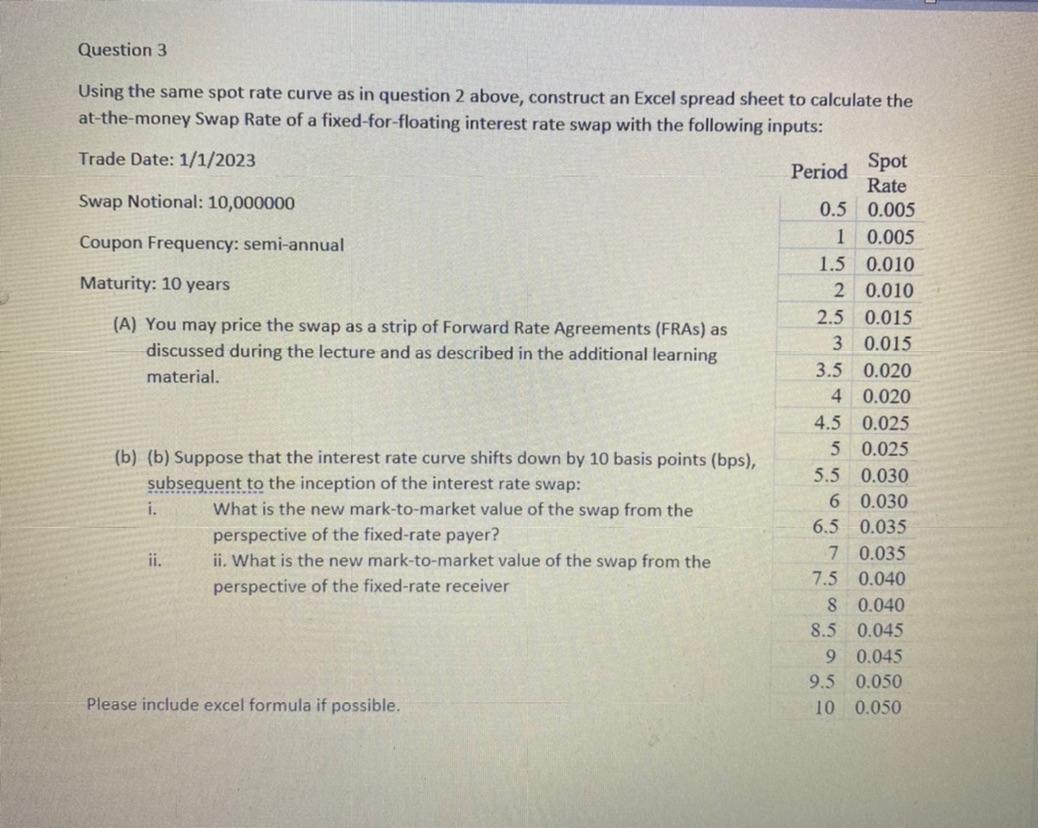

Question 3 Using the same spot rate curve as in question 2 above, construct an Excel spread sheet to calculate the at-the-money Swap Rate of a fixed-for-floating interest rate swap with the following inputs: Trade Date: 1/1/2023 Swap Notional: 10,000000 Period Spot Rate 0.5 0.005 Coupon Frequency: semi-annual Maturity: 10 years 1 0.005 1.5 0.010 2 0.010 2.5 0.015 (A) You may price the swap as a strip of Forward Rate Agreements (FRAs) as discussed during the lecture and as described in the additional learning material. 3 0.015 3.5 0.020 4 0.020 4.5 0.025 5 0.025 (b) (b) Suppose that the interest rate curve shifts down by 10 basis points (bps), subsequent to the inception of the interest rate swap: 5.5 0.030 6 0.030 i. What is the new mark-to-market value of the swap from the perspective of the fixed-rate payer? 6.5 0.035 ii. 7 0.035 ii. What is the new mark-to-market value of the swap from the perspective of the fixed-rate receiver 7.5 0.040 8 0.040 8.5 0.045 Please include excel formula if possible. 9 0.045 9.5 0.050 10 0.050

Step by Step Solution

There are 3 Steps involved in it

Certainly Below is the stepbystep solution for calculating the swap rate and determining the marktomarket value of the swap Ill present the relevant i... View full answer

Get step-by-step solutions from verified subject matter experts