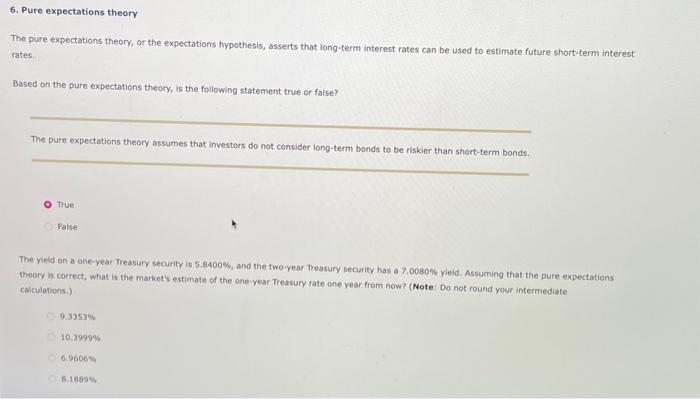

Question: The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future shortuterm interest rates, Based on the

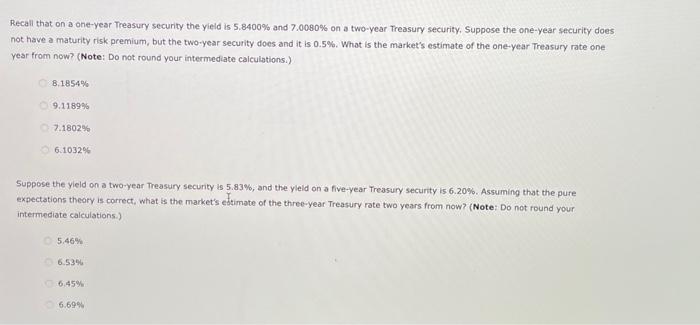

The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future shortuterm interest rates, Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that investors do not consider long-term bonds to be risier than short-term bonds. True False: The yield on a one-year Treasury security is 5,8400\%, and the two-year Treasury security has a 7,00B0\% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate. colculations.) 9.3353% 10.3999\% 6.9606% A. 1 39 Recall that on a one-year. Theasury security the yield is 5.8400% and 7.0080% on a two-year Treasury security, Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.5%. What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) B, 1854% 9.118956 7.1802% 6.1032% Suppose the yield on a two-year Treasury security is 5.83%, and the yleld on a five-year Treasury security is 6.20%. Assuming that the pure expectations theory is correct, what is the market's etsimate of the three-year Treasury rote two years from now? (Note: Do not round your intermediate calculations.) 5. 46% 6.53% 6. 45 \% 6.698

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts