Question: The purpose of this case study assignment is to apply the chapter content into a real world scenario. Students are expected to use content from

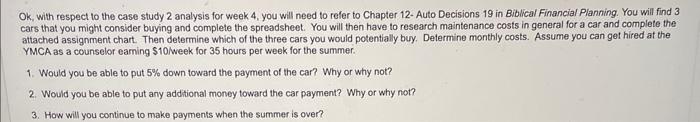

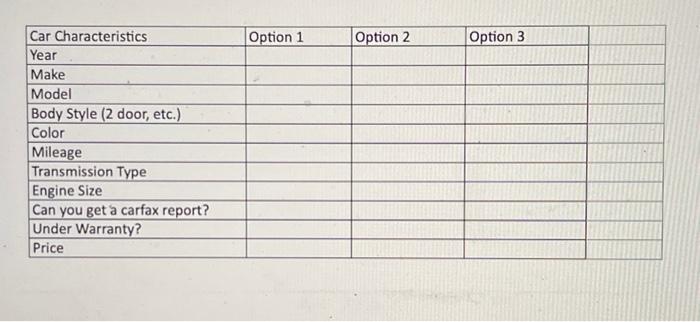

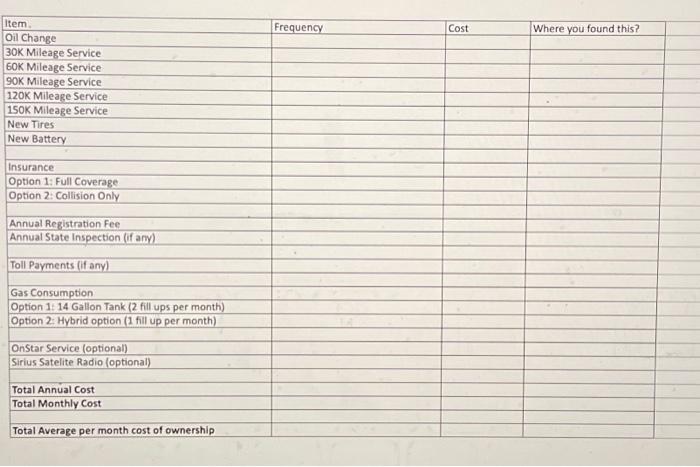

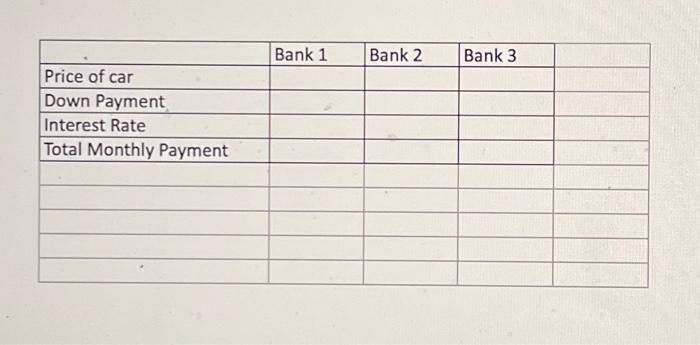

The purpose of this case study assignment is to apply the chapter content into a "real world" scenario. Students are expected to use content from the chapter as well as the supplemental case study information found in the section titled "Case Study Supplemental Information", which is just past Chapter 19 in Biblical Financial Planning: A Biblical Worldview of Personal Finance. Prompts: Using the attached Auto Decision worksheet (see above-provided attachment), follow the instructions for the questions within the Chapter 12 (Auto Decisions) case study. The case study questions require written answers. Therefore, please provide the written answers in a separate Word document (.doc or docx format only). For additional, in-depth instructions, please review the instructions document provided above. Ok, with respect to the case study 2 analysis for week 4 , you will need to refer to Chapter 12 - Auto Decisions 19 in Biblical Financial Planning. You will find 3 cars that you might consider buying and complete the spreadsheet. You will then have to research maintenance costs in general for a car and complete the attached assignment chart. Then determine which of the three cars you would potentially buy. Determine monthly costs. Assume you can get hired at the YMCA as a counselor earning $10/ week for 35 hours per week for the summer. 1. Would you be able to put 5% down toward the payment of the car? Why or why not? 2. Would you be able to put any additional money toward the car payment? Why or why not? 3. How will you continue to make payments when the summer is over? \begin{tabular}{|l|l|l|l|} \hline Car Characteristics & Option 1 & Option 2 & Option 3 \\ \hline Year & & \\ \hline Make & & \\ \hline Model & & \\ \hline Body Style (2 door, etc.) & & \\ \hline Color & & \\ \hline Mileage & & \\ \hline Transmission Type & & \\ \hline Engine Size & & & \\ \hline Can you get a carfax report? & & & \\ \hline Under Warranty? & & & \\ \hline Price & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Bank 1 & Bank 2 & Bank 3 & \\ \hline Price of car & & & & \\ \hline Down Payment & & & & \\ \hline Interest Rate & & & & \\ \hline Total Monthly Payment & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline \end{tabular} The purpose of this case study assignment is to apply the chapter content into a "real world" scenario. Students are expected to use content from the chapter as well as the supplemental case study information found in the section titled "Case Study Supplemental Information", which is just past Chapter 19 in Biblical Financial Planning: A Biblical Worldview of Personal Finance. Prompts: Using the attached Auto Decision worksheet (see above-provided attachment), follow the instructions for the questions within the Chapter 12 (Auto Decisions) case study. The case study questions require written answers. Therefore, please provide the written answers in a separate Word document (.doc or docx format only). For additional, in-depth instructions, please review the instructions document provided above. Ok, with respect to the case study 2 analysis for week 4 , you will need to refer to Chapter 12 - Auto Decisions 19 in Biblical Financial Planning. You will find 3 cars that you might consider buying and complete the spreadsheet. You will then have to research maintenance costs in general for a car and complete the attached assignment chart. Then determine which of the three cars you would potentially buy. Determine monthly costs. Assume you can get hired at the YMCA as a counselor earning $10/ week for 35 hours per week for the summer. 1. Would you be able to put 5% down toward the payment of the car? Why or why not? 2. Would you be able to put any additional money toward the car payment? Why or why not? 3. How will you continue to make payments when the summer is over? \begin{tabular}{|l|l|l|l|} \hline Car Characteristics & Option 1 & Option 2 & Option 3 \\ \hline Year & & \\ \hline Make & & \\ \hline Model & & \\ \hline Body Style (2 door, etc.) & & \\ \hline Color & & \\ \hline Mileage & & \\ \hline Transmission Type & & \\ \hline Engine Size & & & \\ \hline Can you get a carfax report? & & & \\ \hline Under Warranty? & & & \\ \hline Price & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Bank 1 & Bank 2 & Bank 3 & \\ \hline Price of car & & & & \\ \hline Down Payment & & & & \\ \hline Interest Rate & & & & \\ \hline Total Monthly Payment & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts