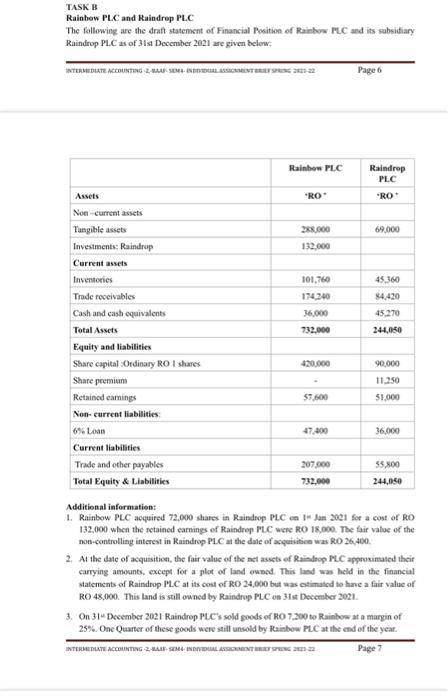

Question: the question depends on Task B TASKB Rainbow PLC and Raindrop PLC The following are the draft statement of Financial Position of Rainbow PLC and

TASKB Rainbow PLC and Raindrop PLC The following are the draft statement of Financial Position of Rainbow PLC and its subsidiary Raindrop PLC as of 3isa December 2021 are given below: INTERMEDIATE ACCOUNTING USERS 21 22 Page 6 Rainbow PLC Raindrop PLC "RO "RO 69,000 288.000 132.000 101,760 174.240 36.000 932,000 45,360 84.420 45.270 244,050 Assets Non current assets Tangible assets Investments: Raindrop Current assets Inventories Trade receivables Cash and cash equivalents Total Assets Equity and liabilities Share capital Ordinary ROI shares Share premium Retained camings Non-current liabilities 6% Loan Current liabilities Trade and other payables Total Equity & Liabilities 420.000 90.000 11.350 57.600 51.000 47.000 36,000 207.000 732.000 35,800 244,050 Additional information: 1. Rainbow PLC acquired 72,000 shares in Raindrop PLC Jan 2001 for a cost of RO 132,000 when the retained earnings of Raindrop PLC were RO 18.000. The fair value of the non-controlling interest in Raindrop PLC at the date of acquatice was RO 26,400. 2. At the date of acquisition, the fair value of the met assets of Raindrop PLC approximated their carrying amounts, except for a plot of land owned. This land was held in the financial statements of Raindrup PLC at its cost of RO 24,000 but was szimated to have a fair value of RO 48,000. This land is still owned by Raindrop PLC on 31st December 2021 3. On 31 December 2021 Raindrop PLC's sold goods of RO 7.200 to Rainbow at a margin of 25%. One Quarter of these goods were still unsold by Rainbow PLC at the end of the year. INTERMEDIATE ACCOUNTING ARSENE INDIVILASSANTISO 203-22 Page 7 Question 2 You are required to: Prepare consolidate statement of financial position as of 31st December 2021 of Rainbow PLC (Provide Reference to IFRS wherever applicable, relevant workings) (Relevant workings 5 marks + consolidated statement of financial position 5 marks +2 Mark for appropriate presentation) (Total Marks Task B = 12 Marks) TASKB Rainbow PLC and Raindrop PLC The following are the draft statement of Financial Position of Rainbow PLC and its subsidiary Raindrop PLC as of 3isa December 2021 are given below: INTERMEDIATE ACCOUNTING USERS 21 22 Page 6 Rainbow PLC Raindrop PLC "RO "RO 69,000 288.000 132.000 101,760 174.240 36.000 932,000 45,360 84.420 45.270 244,050 Assets Non current assets Tangible assets Investments: Raindrop Current assets Inventories Trade receivables Cash and cash equivalents Total Assets Equity and liabilities Share capital Ordinary ROI shares Share premium Retained camings Non-current liabilities 6% Loan Current liabilities Trade and other payables Total Equity & Liabilities 420.000 90.000 11.350 57.600 51.000 47.000 36,000 207.000 732.000 35,800 244,050 Additional information: 1. Rainbow PLC acquired 72,000 shares in Raindrop PLC Jan 2001 for a cost of RO 132,000 when the retained earnings of Raindrop PLC were RO 18.000. The fair value of the non-controlling interest in Raindrop PLC at the date of acquatice was RO 26,400. 2. At the date of acquisition, the fair value of the met assets of Raindrop PLC approximated their carrying amounts, except for a plot of land owned. This land was held in the financial statements of Raindrup PLC at its cost of RO 24,000 but was szimated to have a fair value of RO 48,000. This land is still owned by Raindrop PLC on 31st December 2021 3. On 31 December 2021 Raindrop PLC's sold goods of RO 7.200 to Rainbow at a margin of 25%. One Quarter of these goods were still unsold by Rainbow PLC at the end of the year. INTERMEDIATE ACCOUNTING ARSENE INDIVILASSANTISO 203-22 Page 7 Question 2 You are required to: Prepare consolidate statement of financial position as of 31st December 2021 of Rainbow PLC (Provide Reference to IFRS wherever applicable, relevant workings) (Relevant workings 5 marks + consolidated statement of financial position 5 marks +2 Mark for appropriate presentation) (Total Marks Task B = 12 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts