Question: THE QUESTION HAS MULTIPLE STEPS. FINISH THEM ALL, its 1 question. all of my finance questions have been wrong! (Yield to maturity) Fitzgerald's 35 -year

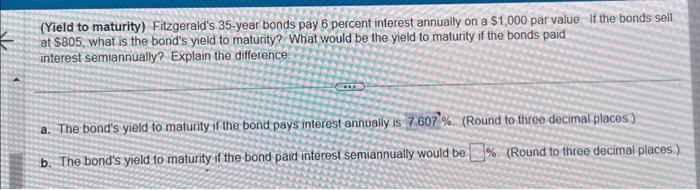

(Yield to maturity) Fitzgerald's 35 -year bonds pay 6 percent interest annually on a $1,000 par value. If the bonds sell at $805, what is the bond's yield to maturity? What would be the yield to maturity if the bonds paid interest semiannualy? Explain the difference a. The bond's yield to maturity if the bond pays interest annually is 7.607%. (Round to three decimal places) b. The bond's yield to maturity if the bond paid interest semiannually would be % (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts