Question: the question is complete Continuing the previous questions, now there is another stock, stock C, that has an expected return of 5 20% and a

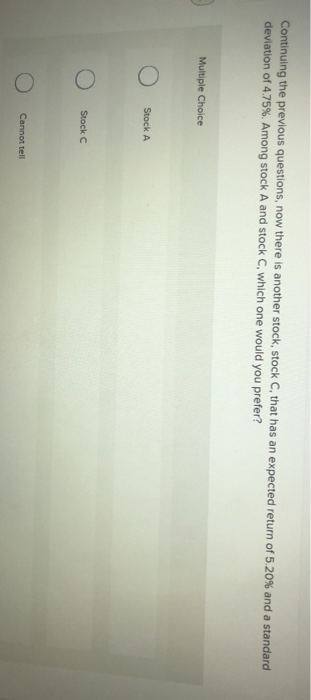

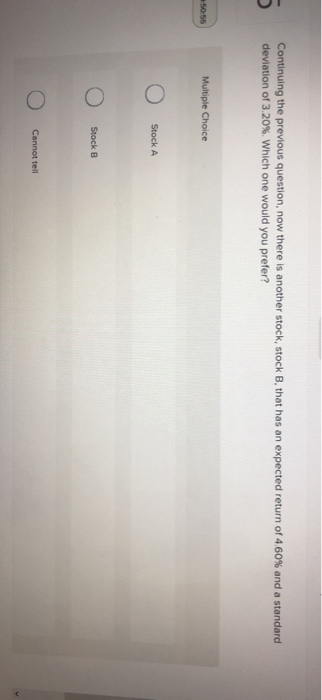

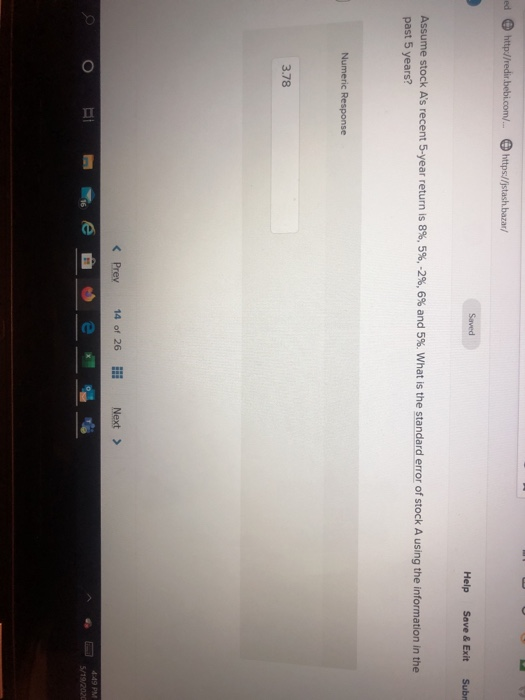

Continuing the previous questions, now there is another stock, stock C, that has an expected return of 5 20% and a standard deviation of 475%. Among stock A and stock C, which one would you prefer? Multiple Choice Stock A O Stock C Cannot tell Continuing the previous question, now there is another stock, stock B, that has an expected return of 4.60% and a standard deviation of 3.20%. Which one would you prefer? 50 55 Multiple Choice Stock A Stock B Cannot tell ed http://redir bebi.com/ https://stash.bazar/ Saved Help Save & Exit Sub Assume stock A's recent 5-year return is 8%,5%, -2%, 6% and 5%. What is the standard error of stock A using the information in the past 5 years? Numeric Response 3.78 o B E e 4:49 PM 5/19/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts