Question: The question is listed under Slide 7 Justification After inputting the 10 values needed for the MDOM apreadsheet, the decision was to Buy' the stock.

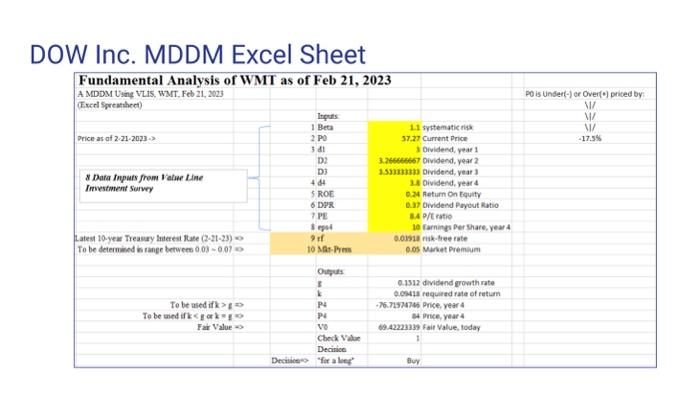

Justification After inputting the 10 values needed for the MDOM apreadsheet, the decision was to "Buy' the stock. Using all the celculaticns and cutput values, this cen be justifed. Initily, an ifrestor might be casticus about buging Dow stock due to the 1.10 beta value. The beta tels the inventor that the stock moves relatirely faster thas the market. which can cause quicker gains or losses over time, but the reward is worth the investment due to the projected price in 4 years totaling $84 coper thare with a current valee of $57,27. Aso, the curted dividend price is $3, but it is expected to increase to $3.80, which is a 0.15 anneal growth rate. The dividend payout ratio is 0.37, so after the compary has paid al its debts and taxes, the ahareholder wil receive 37 of the lefover cash per share. Furthermoce, the shareholder will receive $10 in eamings after 4 years. This can contribuse to large profes depending on the number of shares the investor has. Despite the beta aignaling volatilty, because Dow stock has a positive reputation, the risk premium was set an 0.5 and the fial decision was to buy the stock, not sal in. Als these valuea inctesse as time goes on so the decision to putchase Dow ssock is justified Lastly. the curtent price is underpriced by 17.5%, which ia great for an investor as the stock will grow and provide long term qains. Di III Slide 7 Numerical discussion of the inputs and outputs entered in key formula details used in the input and output cells in the above MDDM file. (Do not just copy and paste the Excel formulas. You are to explain the numerical inputs and outputs in the context of formulas. You should include a discussion if your company's Fair Value (V0) is based on the original DDM or the MDDM, by confirming if the fair value uses the P4 based on if k>g or the P4 based on if k

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts