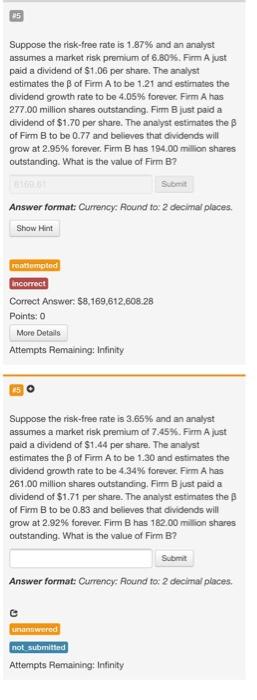

Question: The question on the top has correct answer to show you how the answer needs to be for question on the bottom, thank you. Suppose

Suppose the risk-free rate is 1.87% and an analyst assumes a market risk premium of 6.80%. Firm Ajust paid a dividend of $1.06 per share. The analyst estimates the B of Firm A to be 1.21 and estimates the dividend growth rate to be 4.05% forever. Firm A has 277.00 million shares outstanding. Firm Bjust paid a dividend of $1.70 per share. The analyst estimates the B of Firm B to be 0.77 and believes that dividends will grow at 2.95% forever. Firm B has 194.00 million shares outstanding. What is the value of Firm B? Suomet Answer format: Currency. Round to: 2 decimal places. Show Hint rattempted incorrect Correct Answer: $8,169,612,608.28 Points: 0 More Details Attempts Remaining: Infinity Suppose the risk-free rate is 3.65% and an analyst assumes a market risk premium of 7.45%. Frm Ajust paid a dividend of $1.44 per share. The analyst estimates the of Firm A to be 1.30 and estimates the dividend growth rate to be 4.34% forever. Firm A has 261.00 million shares outstanding. Firm Bjust paid a dividend of $1.71 per share. The analyst estimates the of Firm B to be 0.83 and believes that dividends will grow at 2.92% forever. Firm B has 182.00 million shares outstanding. What is the value of Firm B? Submit Answer format: Currency: Pound to: 2 decimal places unanswered not submitted Attempts Remaining: Infinity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts