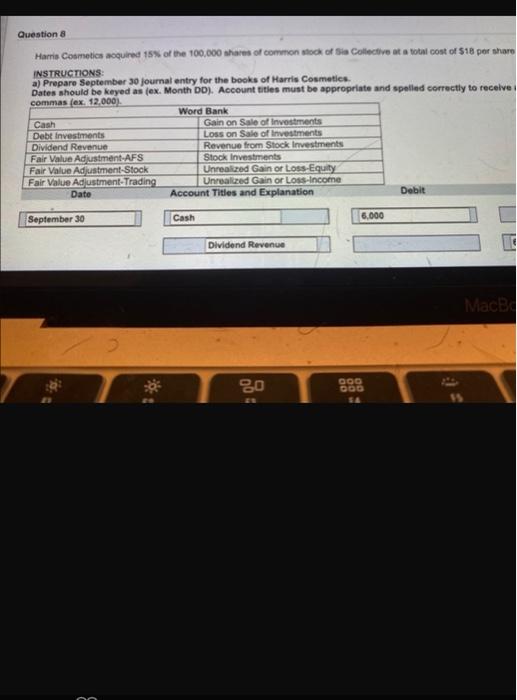

Question: the queStion was long took 2 pics. please show work Question & Harris Cosmetics acquired 15% of the 100.000 shares of common stock of Sia

Question & Harris Cosmetics acquired 15% of the 100.000 shares of common stock of Sia Collective et a total cost of $18 per share INSTRUCTIONS a) Prepare September 30 journal entry for the books of Harris Cosmetics Dates should be keyed as (ex. Month DD). Account titles must be appropriate and spelled correctly to receive commas (ex. 12,000) Word Bank Cash Gain on Sale of Investments Debt Investments Loss on Sale of investments Dividend Revenue Revenue from Stock Investments Fair Value Adjustment AFS Stock Investments Fair Value Adjustment-Stock Unrealed Gain or Loss Equity Fair Value Adjustment Trading Unrealized Gain or Loss Income Date Account Titles and Explanation Debit September 30 Cash 6,000 Dividend Revenue Mac | OQO 80 14 m 2 points Collective at a total cost of $18 per share on July 18, 2020. On September 30, Sia Collective declared and paid a 540.000 dividend. Saver riate and spelled correctly to receive any credit. Refer to the provided word bank for assistanco. Amounts must be written using MacBook Air dd F7 DI! F8 9 F10 ( ) 7 & 7 6 * o 8 9 0 Question & Harris Cosmetics acquired 15% of the 100.000 shares of common stock of Sia Collective et a total cost of $18 per share INSTRUCTIONS a) Prepare September 30 journal entry for the books of Harris Cosmetics Dates should be keyed as (ex. Month DD). Account titles must be appropriate and spelled correctly to receive commas (ex. 12,000) Word Bank Cash Gain on Sale of Investments Debt Investments Loss on Sale of investments Dividend Revenue Revenue from Stock Investments Fair Value Adjustment AFS Stock Investments Fair Value Adjustment-Stock Unrealed Gain or Loss Equity Fair Value Adjustment Trading Unrealized Gain or Loss Income Date Account Titles and Explanation Debit September 30 Cash 6,000 Dividend Revenue Mac | OQO 80 14 m 2 points Collective at a total cost of $18 per share on July 18, 2020. On September 30, Sia Collective declared and paid a 540.000 dividend. Saver riate and spelled correctly to receive any credit. Refer to the provided word bank for assistanco. Amounts must be written using MacBook Air dd F7 DI! F8 9 F10 ( ) 7 & 7 6 * o 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts