Question: The readings this week cover important forces in the external environment. The attached article presents examples of companies that declined because their commitment to a

The readings this week cover important forces in the external environment. The attached article presents examples of companies that declined because their commitment to a product or technology was so deep it missed important opportunities. Please read this interesting article. For our opening question, please summarize (200 words or less) the key points you took away from reading it.

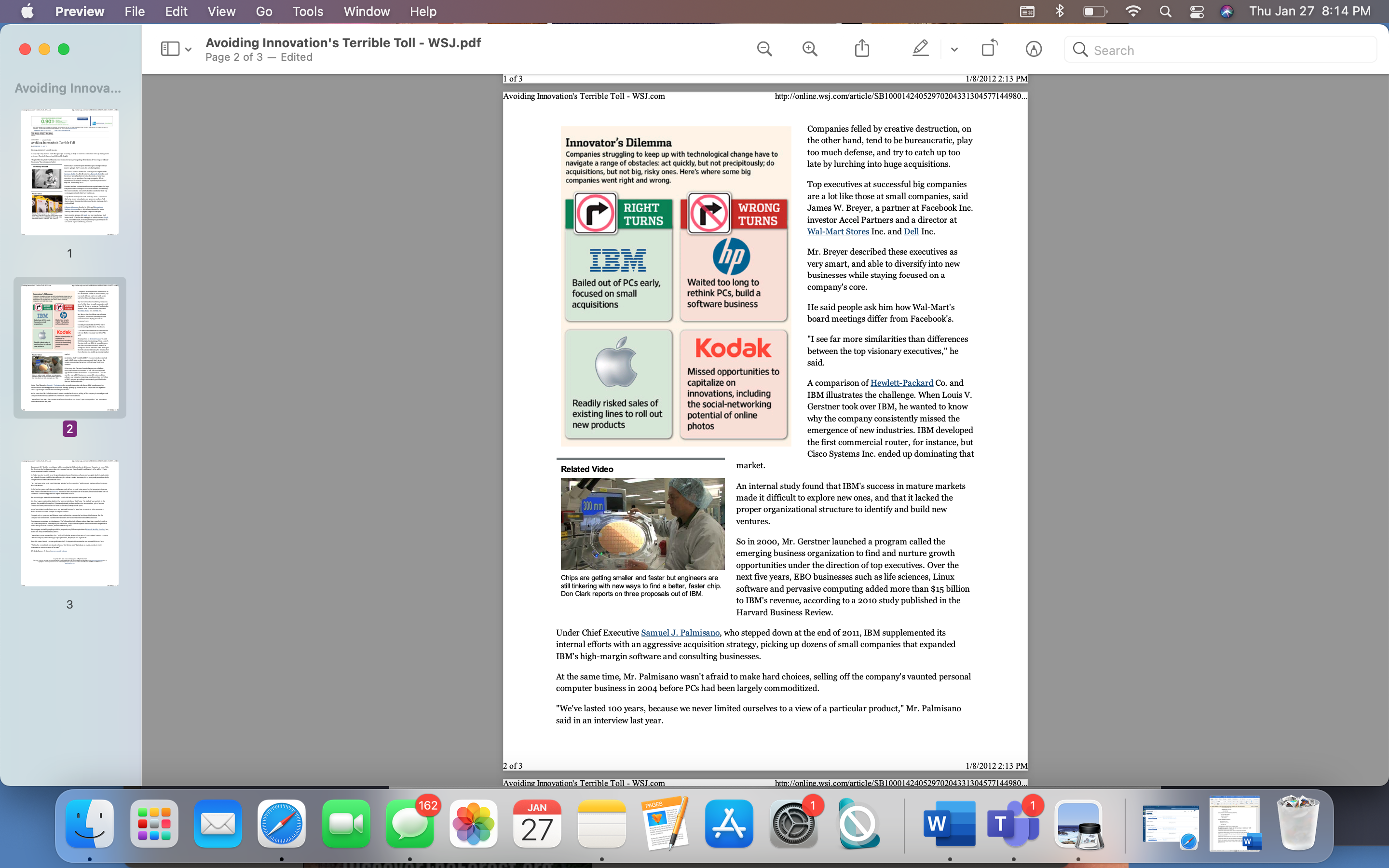

Preview File Edit View Go Tools Window Help Q 8 Thu Jan 27 8:14 PM Avoiding Innovation's Terrible Toll - WSJ.pdf Page 1 of 3 - Edited Q Q Search Avoiding Innova... Avoiding Innovation's Terrible Toll - WSJ.com http://online.wsj.com/article/SB10001424052970204331304577144980... 0.905 HIGH-YIELD SAVINGS ACCOUNT LEARN MORE > 0.90 % Pic Insure Y No Minimum Balance PERSONAL SAVINGS Jones Reprints: This cop er Reprints tool at the bottom of any article or visit www.aireprints. mentation-ready copies for distribution to your colleagues, clients or See a sample reprint in PDF format. Order a reprint of this article now THE WALL STREET JOURNAL. VSJ.com MANAGEMENT JANUARY 7, 2012 Avoiding Innovation's Terrible Toll By SPENCER E. ANTE The corporation isn't a sturdy species. IBM In fact, only a tiny fraction reach the age of 40, according to study of more than six million firms by management professors Charles I. Stubbart and Michael B. Knight. "Despite their size, their vast financial and human resources, average large firms do not 'live' as long as ordinary Americans," the authors concluded The History of Koda Given today's increased pace of technological change, even 40 ears is going to start to seem like a really long time. The wave of creative destruction looming over companies like Eastman Kodak Co., Blockbuster Inc., Barnes & Noble Inc. and the record labels has been focusing the minds of American executives on two questions: Are large companies able to innovate quickly enough in an age of rapid disruption? And if they can, how do they do it? Business leaders, academics and venture capitalists say the large companies that do manage to survive are ruthless about change. The most successful ones aren't afraid to cannibalize their big Related Video revenue generators to build new businesses. They often make frequent-but, crucially, small-acquisitions that bring in new technologies and open new markets. And Kodak B Kodak there's always the unpredictable role of luck in business-both good and bad. 3 Johnson & Johnson, founded in 1886, and International Business Machines Corp., which just celebrated its 10oth birthday, have defied the 40-year corporate life span. Eastman Kodak is preparing for a Chapter 11 bankruptcy-protection filing in the coming weeks sho More recently, 35-year-old Apple Inc. has transformed itself efforts to sell a trove of digital patents fall through. Mattioli has details on The News Hub. Photo: AP from a small PC maker into a kingpin of mobile devices. Google Corp., founded in 1998, is finding new ways to grow beyond its core search engine advertising business. 1 of 3 1/8/2012 2:13 PM Avoiding Innovation's Terrible Toll - WSJ.com http://online.wsj.com/article/SB10001424052970204331304577144980.. 162 JAN PAGES 1 27 4 W WPreview File Edit View Go Tools Window Help Q 8 Thu Jan 27 8:14 PM Avoiding Innovation's Terrible Toll - WSJ.pdf Page 2 of 3 - Edited Q Q Search 1 of 3 Avoiding Innova... 1/8/2012 2:13 PM Avoiding Innovation's Terrible Toll - WSJ.com http://online.wsj.com/article/SB10001424052970204331304577144980... 0.905 Companies felled by creative destruction, on Innovator's Dilemma the other hand, tend to be bureaucratic, play Companies struggling to keep up with technological change have to too much defense, and try to catch up too navigate a range of obstacles: act quickly, but not precipitous acquisitions, but not big, risky ones. Here's where some big late by lurching into huge acquisitions. companies went right and wrong. Top executives at successful big companies are a lot like those at small companies, said RIGHT WRONG James W. Breyer, a partner at Facebook Inc. TURNS TURNS investor Accel Partners and a director at Wal-Mart Stores Inc. and Dell Inc. IBM hp Mr. Breyer described these executives as very smart, and able to diversify into new businesses while staying focused on a Bailed out of PCs early, Waited too long to focused on small rethink PCs, build a company's core acquisitions software business He said people ask him how Wal-Mart's board meetings differ from Facebook's Kodak "I see far more similarities than differences between the top visionary executives," he aid. Missed opportunities to capitalize on A comparison of Hewlett-packard Co. and innovations, including Readily risked sales of IBM illustrates the challenge. When Louis V. the social-networking Gerstner took over IBM, he wanted to know existing lines to roll out potential of online 2 new products why the company consistently missed the photos emergence of new industries. IBM developed the first commercial router, for instance, but Cisco Systems Inc. ended up dominating that Related Video market. An internal study found that IBM's success in mature markets made it difficult to explore new ones, and that it lacked the 300 mm proper organizational structure to identify and build new ventures. So in 2000, Mr. Gerstner launched a program called the emerging business organization to find and nurture growth opportunities under the direction of top executives. Over the Chips are getting smaller and faster but engineers are next five years, EBO businesses such as life sciences, Linux still tinkering with new ways to find a better, faster chip. Don Clark reports on three proposals out of IBM. software and pervasive computing added more than $15 billion 3 o IBM's revenue, according to a 2010 study published in the Harvard Business Review. Under Chief Executive Samuel J. Palmisano, who stepped down at the end of 2011, IBM supplemented its internal efforts with an aggressive acquisition strategy, picking up dozens of small companies that expanded IBM's high-margin software and consulting businesses At the same time, Mr. Palmisano wasn't afraid to make hard choices, selling off the company's vaunted personal computer business in 2004 before PCs had been largely commoditized. "We've lasted 100 years, because we never limited ourselves to a view of a particular product," Mr. Palmisano said in an interview last year. 2 of 3 1/8/2012 2:13 PM Avoiding Innovation's Terrible Toll - WSJ.com http:/online.wsi.com/article/SB10001424052970204331304577144980.. YO O 162 JAN PAGES 1 27 4 W WPreview File Edit View Go Tools Window Help Q 8 Thu Jan 27 8:14 PM Avoiding Innovation's Terrible Toll - WSJ.pdf Page 3 of 3 - Edited Q Search Avoiding Innova... 2 of 3 1/8/2012 2:13 PM Avoiding Innovation's Terrible Toll - WSJ.com http://online.wsj.com/article/SB10001424052970204331304577144980... 0.905 By contrast, H-P decided to get bigger in PCs, spending $25 billion to buy rival Compaq Computer in 2002. With the threats to that business now clear, the company last year clumsily said it might spin it off or sell its PC unit, before investors forced it to retreat. H-P also was slow to catch on to the growing importance of business software and has spent dearly to try to catch up. When H-P spent $11 billion last fall to acquire software maker Autonomy Corp., many analysts said the deal's rich price would destroy shareholder value "H-P has been trying to do everything IBM is doing but five years late," said Harvard Business School professor Rosabeth Kanter. In the last few years, Apple has provided a case study in how to avoid being snared by the innovator's dilemma. After former Chief Executive Steve Jobs returned to the company in the early 1990s, he refreshed its PC line and carved out a dominating position in digital music with the iPod. But he readily put both of those busin es at risk with new products several years later. Mr. Jobs began cannibalizing Apple's iPod when he introduced the iPhone. The tradeoff was worth it. In the quarter that ended in September, iPhones and related products and services accounted for 39% of Apple's revenue and have positioned it as a leader in the fast-growing mobile space Apple later risked cannibalizing its PC and notebook business by launching its new ipad tablet computer, a device that now accounts for 24% of company revenue. Google is only 13 years old, and Internet search advertising remains the backbone of its business. But the company has used modest acquisitions to dominate new markets that threatened its dominance. Google's most prominent new businesses-YouTube and its Android smartphone franchise-were both built on the back of acquisitions. After buying the companies, Google let them operate with considerable independence under their passionate founders, then beefed them up later. The company took a bigger plunge with its proposed $12.5 billion acquisition of Motorola Mobility Holdings Inc., a deal still being reviewed by regulators. "A good M&A program can help a lot," said Todd Chaffee, a general partner with Institutional Venture Partners. "If some company is threatening [Google's] business, they buy it and augment it." Even if it seems there is a proven path to survival, it's important to remember one undeniable factor: luck. "We tend to overestimate how much we know," Mr. Breyer said. "Luck plays an enormous role in every investment or corporate story of success." Write to Spencer E. Ante at spencer.ante@wsj.com 3 Copyright 2011 Dow Jones & Company, Inc. All Rights Reserved This copy is for your personal, non-commercial use Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com 3 of 3 1/8/2012 2:13 PM 162 JAN PAGES 27 4 O 1 W W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts