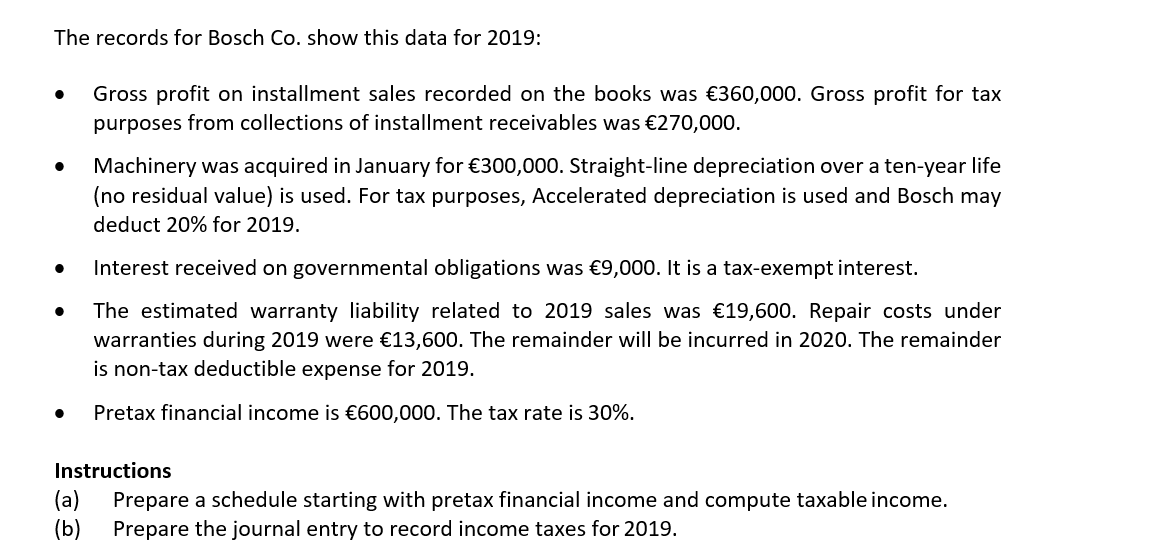

Question: The records for Bosch Co. show this data for 2019: Gross profit on installment sales recorded on the books was 360,000. Gross profit for tax

The records for Bosch Co. show this data for 2019: Gross profit on installment sales recorded on the books was 360,000. Gross profit for tax purposes from collections of installment receivables was 270,000. . Machinery was acquired in January for 300,000. Straight-line depreciation over a ten-year life (no residual value) is used. For tax purposes, Accelerated depreciation is used and Bosch may deduct 20% for 2019. Interest received on governmental obligations was 9,000. It is a tax-exempt interest. . The estimated warranty liability related to 2019 sales was 19,600. Repair costs under warranties during 2019 were 13,600. The remainder will be incurred in 2020. The remainder is non-tax deductible expense for 2019. Pretax financial income is 600,000. The tax rate is 30%. Instructions (a) Prepare a schedule starting with pretax financial income and compute taxable income. (b) Prepare the journal entry to record income taxes for 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts