Question: The records for Ehrlich Co. show this data for 2020: Gross profit on installment sales recorded on the books was $480,000. Gross profit from collections

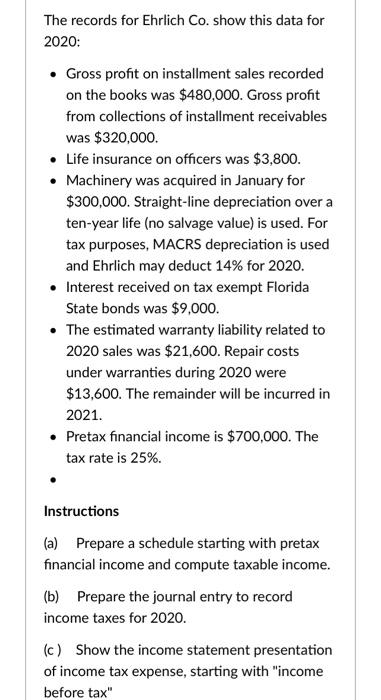

The records for Ehrlich Co. show this data for 2020:

- Gross profit on installment sales recorded on the books was $480,000. Gross profit from collections of installment receivables was $320,000.

- Life insurance on officers was $3,800.

- Machinery was acquired in January for $300,000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, MACRS depreciation is used and Ehrlich may deduct 14% for 2020.

- Interest received on tax exempt Florida State bonds was $9,000.

- The estimated warranty liability related to 2020 sales was $21,600. Repair costs under warranties during 2020 were $13,600. The remainder will be incurred in 2021.

- Pretax financial income is $700,000. The tax rate is 25%.

Instructions

(a) Prepare a schedule starting with pretax financial income and compute taxable income.

(b) Prepare the journal entry to record income taxes for 2020.

(c ) Show the income statement presentation of income tax expense, starting with "income before tax"

The records for Ehrlich Co. show this data for 2020: Gross profit on installment sales recorded on the books was $480,000. Gross profit from collections of installment receivables was $320,000. Life insurance on officers was $3,800. Machinery was acquired in January for $300,000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, MACRS depreciation is used and Ehrlich may deduct 14% for 2020. Interest received on tax exempt Florida State bonds was $9.000. The estimated warranty liability related to 2020 sales was $21,600. Repair costs under warranties during 2020 were $13,600. The remainder will be incurred in 2021. Pretax financial income is $700,000. The tax rate is 25%. Instructions (a) Prepare a schedule starting with pretax financial income and compute taxable income. (b) Prepare the journal entry to record income taxes for 2020. (c) Show the income statement presentation of income tax expense, starting with "income before tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts