Question: The relevant factor(s) in computing depreciation include: A Cost B. Salvage value C. Useful life D. Depreciation method E. All of the above to. Depreciation:

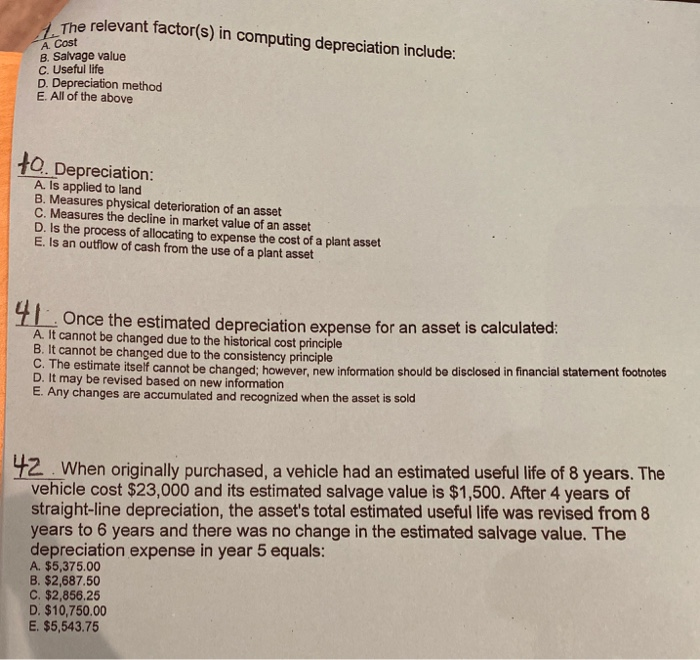

The relevant factor(s) in computing depreciation include: A Cost B. Salvage value C. Useful life D. Depreciation method E. All of the above to. Depreciation: A. Is applied to land B. Measures physical deterioration of an asset C. Measures the decline in market value of an asset D. Is the process of allocating to expense the cost of a plant asset E. Is an outflow of cash from the use of a plant asset 1 . Once the estimated depreciation expense for an asset is calculated: A. It cannot be changed due to the historical cost principle B. It cannot be changed due to the consistency principle C. The estimate itself cannot be changed: however, new information should be disclosed in financial statement footnotes D. It may be revised based on new information E. Any changes are accumulated and recognized when the asset is sold 42. When originally purchased, a vehicle had an estimated useful life of 8 years. The vehicle cost $23,000 and its estimated salvage value is $1,500. After 4 years of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value. The depreciation expense in year 5 equals: A. $5,375.00 B. $2,687.50 C. $2,856.25 D. $10,750.00 E. $5,543.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts