Question: the rest of question is about cite the reference which I think it's not important. I only need to know which one is assessable income

the rest of question is about cite the reference which I think it's not important. I only need to know which one is assessable income or allowable deduction. Thank you

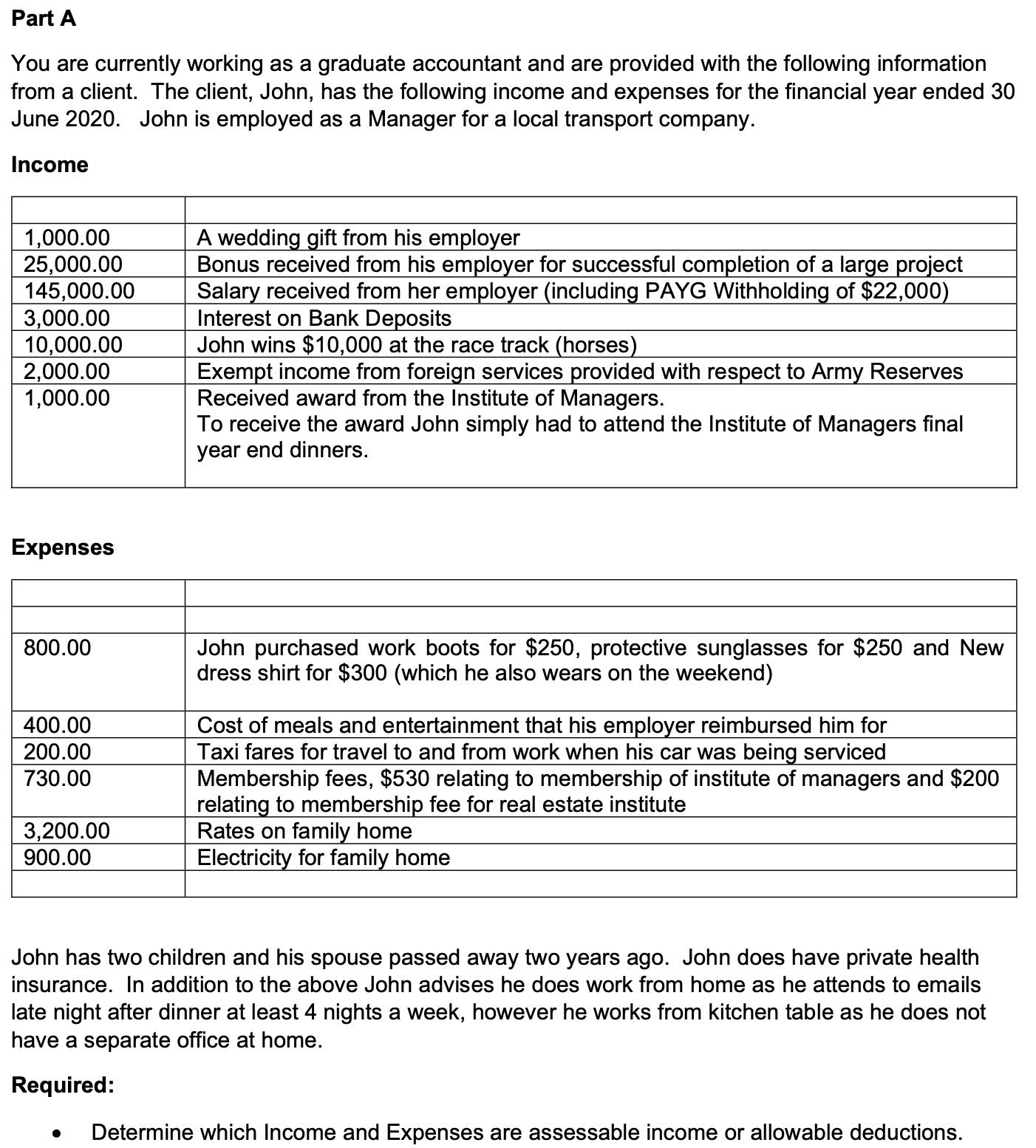

Part A You are currently working as a graduate accountant and are provided with the following information from a client. The client, John, has the following income and expenses for the financial year ended 30 June 2020. John is employed as a Manager for a local transport company. Income 1,000.00 A wedding gift from his employer 25,000.00 Bonus received from his employer for successful completion of a large project 145,000.00 Salary received from her employer (including PAYG Withholding of $22,000) 3,000.00 Interest on Bank Deposits 10,000.00 John wins $10,000 at the race track (horses) 2,000.00 Exempt income from foreign services provided with respect to Army Reserves 1,000.00 Received award from the Institute of Managers. To receive the award John simply had to attend the Institute of Managers final year end dinners. Expenses 800.00 John purchased work boots for $250, protective sunglasses for $250 and New dress shirt for $300 (which he also wears on the weekend) 400.00 Cost of meals and entertainment that his employer reimbursed him for 200.00 Taxi fares for travel to and from work when his car was being serviced 730.00 Membership fees, $530 relating to membership of institute of managers and $200 relating to membership fee for real estate institute 3,200.00 Rates on family home 900.00 Electricity for family home John has two children and his spouse passed away two years ago. John does have private health insurance. In addition to the above John advises he does work from home as he attends to emails late night after dinner at least 4 nights a week, however he works from kitchen table as he does not have a separate office at home. Required: Determine which Income and Expenses are assessable income or allowable deductions

Part A You are currently working as a graduate accountant and are provided with the following information from a client. The client, John, has the following income and expenses for the financial year ended 30 June 2020. John is employed as a Manager for a local transport company. Income 1,000.00 A wedding gift from his employer 25,000.00 Bonus received from his employer for successful completion of a large project 145,000.00 Salary received from her employer (including PAYG Withholding of $22,000) 3,000.00 Interest on Bank Deposits 10,000.00 John wins $10,000 at the race track (horses) 2,000.00 Exempt income from foreign services provided with respect to Army Reserves 1,000.00 Received award from the Institute of Managers. To receive the award John simply had to attend the Institute of Managers final year end dinners. Expenses 800.00 John purchased work boots for $250, protective sunglasses for $250 and New dress shirt for $300 (which he also wears on the weekend) 400.00 Cost of meals and entertainment that his employer reimbursed him for 200.00 Taxi fares for travel to and from work when his car was being serviced 730.00 Membership fees, $530 relating to membership of institute of managers and $200 relating to membership fee for real estate institute 3,200.00 Rates on family home 900.00 Electricity for family home John has two children and his spouse passed away two years ago. John does have private health insurance. In addition to the above John advises he does work from home as he attends to emails late night after dinner at least 4 nights a week, however he works from kitchen table as he does not have a separate office at home. Required: Determine which Income and Expenses are assessable income or allowable deductions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock