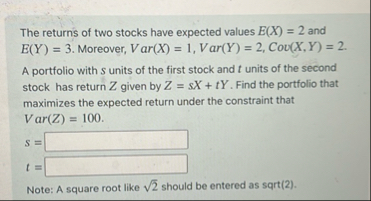

Question: The returns of two stocks have expected values E ( x ) = 2 and E ( Y ) = 3 . Moreover, Var (

The returns of two stocks have expected values and Moreover, VarVarCov

A portfolio with units of the first stock and units of the second stock has return given by Find the portfolio that maximizes the expected return under the constraint that

Var

Note: A square root like should be entered as sqrt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock