Question: The same questions if pics not clear : An auto supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual

The same questions if pics not clear :

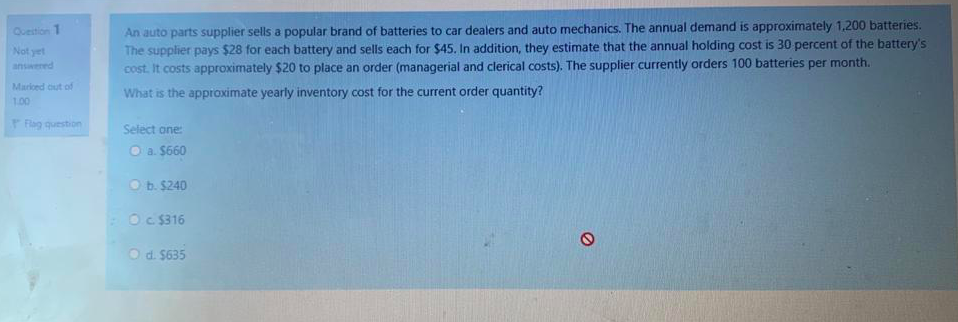

- An auto supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximately 1,200 batteries The supplier pays $28 for each battery and sells each for $45. in addition, they estimate that the annual holding cost is 30 percent of the batterys cost. It costs approximately $20 to place an order (managerial and clerical costs). The supplier currently orders 100 batteries per month. What is the approximate yearly inventory cost for the current order quantity ?

a.$660

b.$240

c.$316

d.$635

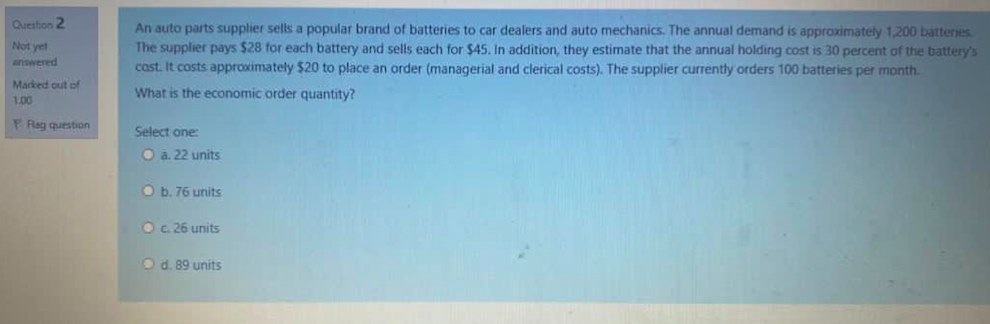

2. An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximate 1.200 The suppler pays $28 for each battery and sells for $45. In addition they estimate that the annual holding cost is 30 percent of the batterys cost. It costs approximately $20 to place an order (managerial and clerical costs) The supplier currently orders 100 batteries per month .

What is the economic order quantity?

Select one:

a.22units

b.76 units

c.26 units

d.89units

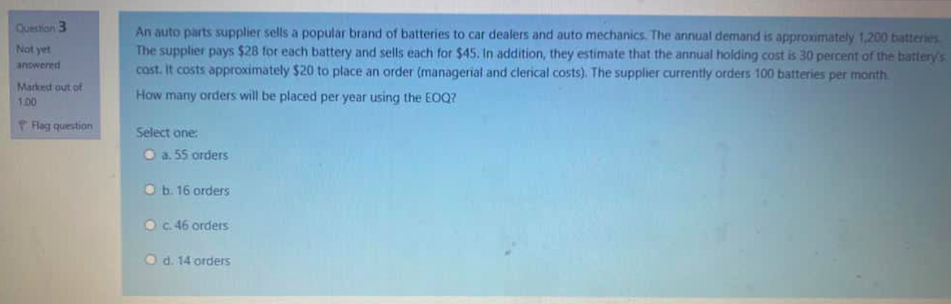

3. An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximate 1.200 The suppler pays $28 for each battery and sells for $45. In addition they estimate that the annual holding cost is 30 percent of the batterys cost. It costs approximately $20 to place an order (managerial and clerical costs) The supplier currently orders 100 batteries per month .

How many orders will be placed per year using the EOQ?

select One:

a. 55 orders

b. 16 orders

c. 46 orders

d. 14 orders

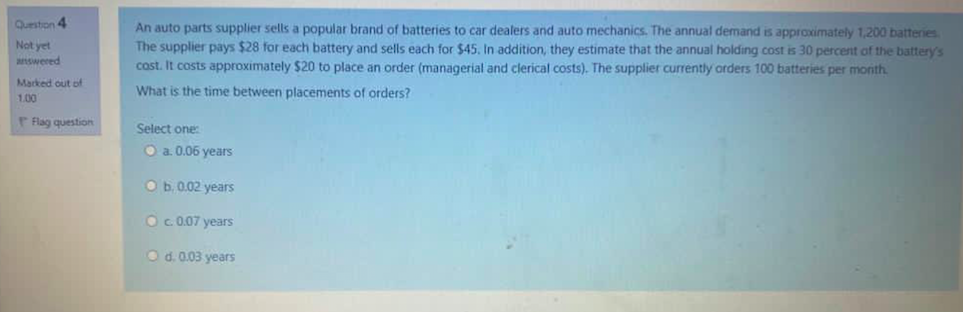

4. An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximate 1.200 The suppler pays $28 for each battery and sells for $45. In addition they estimate that the annual holding cost is 30 percent of the batterys cost. It costs approximately $20 to place an order (managerial and clerical costs) The supplier currently orders 100 batteries per month. What is the time between placements of orders?

a.0.06 years

b.0.02 years

c.0.07 years

d.0.03 years

Question Not yet An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximately 1,200 batteries. The supplier pays $28 for each battery and sells each for $45. In addition, they estimate that the annual holding cost is 30 percent of the battery's cost. It costs approximately $20 to place an order (managerial and clerical costs). The supplier currently orders 100 batteries per month. What is the approximate yearly inventory cost for the current order quantity? Mariod out of 1.00 la question Select one a $660 b. $240 $316 d. $635 Queston 2 Not yet answered An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximately 1.200 batteries The supplier pays $28 for each battery and sells each for $45. In addition, they estimate that the annual holding cost is 30 percent of the battery's cast. It costs approximately $20 to place an order (managerial and clerical costs). The supplier currently orders 100 batteries per month What is the economic order quantity? Marked out of 1.00 Reg question Select one a. 22 units b. 76 units c. 26 units d. 89 units Ocion 3 Not yet anowered Marked out of 1.00 An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximately 1,200 batteries The supplier pays $28 for each battery and sells each for $45. In addition, they estimate that the annual holding cost is 30 percent of the battery's cost. It costs approximately $20 to place an order (managerial and clerical costs). The supplier currently orders 100 batteries per month How many orders will be placed per year using the EOQ? Hag question Select one: a. 55 orders b. 16 orders c. 46 orders d. 14 orders Questo 4 Not ye wered An auto parts supplier sells a popular brand of batteries to car dealers and auto mechanics. The annual demand is approximately 1,200 batteries The supplier pays $28 for each battery and sells each for $45. In addition, they estimate that the annual holding cost is 30 percent of the battery's cost. It costs approximately $20 to place an order (managerial and clerical costs). The supplier currently orders 100 batteries per month What is the time between placements of orders? Marked out of 1.00 Flag question Select one: O a 0.06 years ob. 0.02 years OC. 0.07 years d. 0.03 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts