Question: the second image is for 5% per year. The Smiths save $17,000 per year for retirement. They are now in their mid-twenties, and they expect

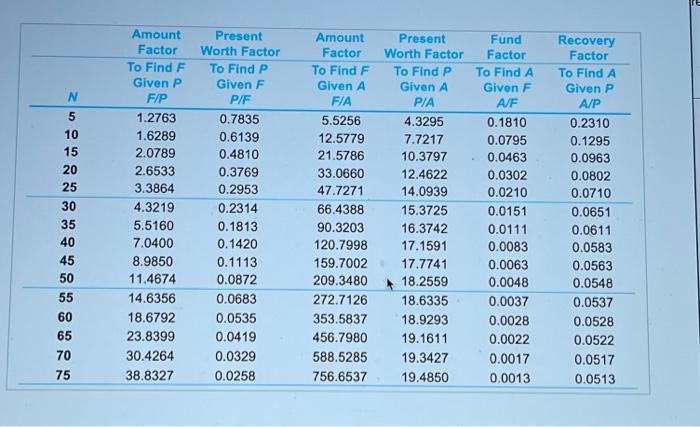

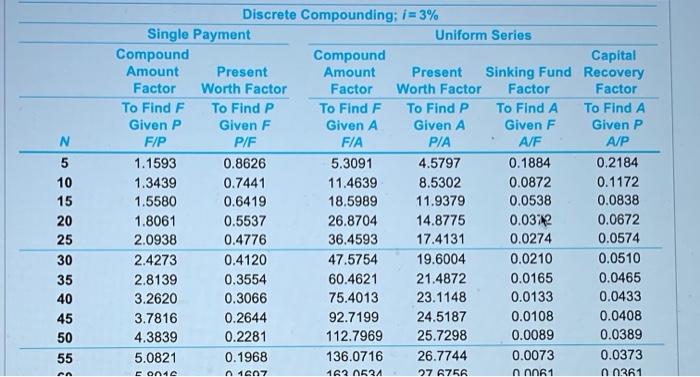

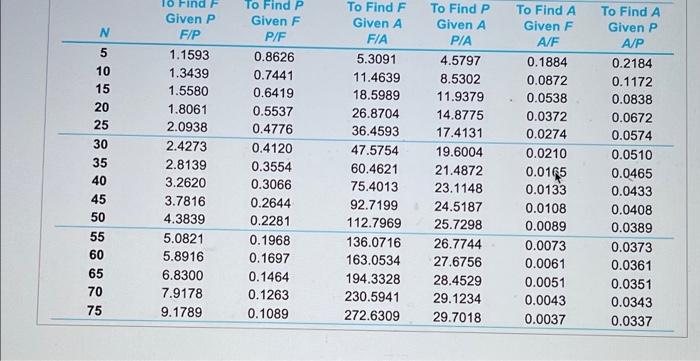

The Smiths save $17,000 per year for retirement. They are now in their mid-twenties, and they expect to have 51 million in today's dollars saved by the time they're in their mid-sites. If their market interest rate is 5% per year, inflation averages 3% a year, and they save for 40 years, is their financial plan possible? Click the icon to view the Interest and annuity table for discrete compounding when/=5% per year Click the icon to view the interest and annuity table for discrete compounding when i 3% per year, The purchasing power in today's dollars of the Smiths' savings les mousand (Round to two decimal places) ooz N 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 Amount Factor To Find F Given P F/P 1.2763 1.6289 2.0789 2.6533 3.3864 4.3219 5.5160 7.0400 8.9850 11.4674 14.6356 18.6792 23.8399 30.4264 38.8327 Present Worth Factor To Find P Given F P/F 0.7835 0.6139 0.4810 0.3769 0.2953 0.2314 0.1813 0.1420 0.1113 0.0872 0.0683 0.0535 0.0419 0.0329 0.0258 Amount Factor To Find F Given A FIA 5.5256 12.5779 21.5786 33.0660 47.7271 66.4388 90.3203 120.7998 159.7002 209.3480 272.7126 353.5837 456.7980 588.5285 756.6537 Present Worth Factor To Find P Given A P/A 4.3295 7.7217 10.3797 12.4622 14.0939 15.3725 16.3742 17.1591 17.7741 18.2559 18.6335 18.9293 19.1611 19.3427 19.4850 Fund Factor To Find A Given F A/F 0.1810 0.0795 0.0463 0.0302 0.0210 0.0151 0.0111 0.0083 0.0063 0.0048 0.0037 0.0028 0.0022 0.0017 0.0013 Recovery Factor To Find A Given P A/P 0.2310 0.1295 0.0963 0.0802 0.0710 0.0651 0.0611 0.0583 0.0563 0.0548 0.0537 0.0528 0.0522 0.0517 0.0513 N 5 10 15 20 25 30 35 40 45 50 55 Discrete Compounding; i = 3% Single Payment Uniform Series Compound Compound Capital Amount Present Amount Present Sinking Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P F/P P/F FIA PIA A/F A/P 1.1593 0.8626 5.3091 4.5797 0.1884 0.2184 1.3439 0.7441 11.4639 8.5302 0.0872 0.1172 1.5580 0.6419 18.5989 11.9379 0.0538 0.0838 1.8061 0.5537 26.8704 14.8775 0.0372 0.0672 2.0938 0.4776 36.4593 17.4131 0.0274 0.0574 2.4273 0.4120 47.5754 19.6004 0.0210 0.0510 2.8139 0.3554 60.4621 21.4872 0.0165 0.0465 3.2620 0.3066 75.4013 23.1148 0.0133 0.0433 3.7816 0.2644 92.7199 24.5187 0.0108 0.0408 4.3839 0.2281 112.7969 25.7298 0.0089 0.0389 5.0821 0.1968 136.0716 26.7744 0.0073 0.0373 162 0521 27 6756 nnn01 n0361 AA One 1007 To Find F Given A FIA on N 5 10 15 20 25 30 35 40 45 50 55 60 65 70 To Find Given P F/P 1.1593 1.3439 1.5580 1.8061 2.0938 2.4273 2.8139 3.2620 3.7816 4.3839 5.0821 5.8916 6.8300 7.9178 9.1789 To Find P Given F P/F 0.8626 0.7441 0.6419 0.5537 0.4776 0.4120 0.3554 0.3066 0.2644 0.2281 0.1968 0.1697 0.1464 0.1263 0.1089 5.3091 11.4639 18.5989 26.8704 36.4593 47.5754 60.4621 75.4013 92.7199 112.7969 136.0716 163.0534 194.3328 230.5941 272.6309 To Find P Given A P/A 4.5797 8.5302 11.9379 14.8775 17.4131 19.6004 21.4872 23.1148 24.5187 25.7298 26.7744 27.6756 28.4529 29.1234 29.7018 To Find A Given F A/F 0.1884 0.0872 0.0538 0.0372 0.0274 0.0210 0.0165 0.0133 0.0108 0.0089 0.0073 0.0061 0.0051 0.0043 0.0037 To Find A Given P A/P 0.2184 0.1172 0.0838 0.0672 0.0574 0.0510 0.0465 0.0433 0.0408 0.0389 0.0373 0.0361 0.0351 0.0343 0.0337 75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts