Question: the second pic for part a and the third for c Nine $1000 bonds with 7.4% coupons payable semi-annually are purchased three months after a

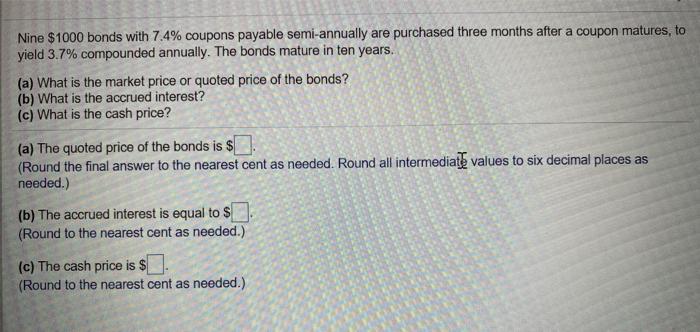

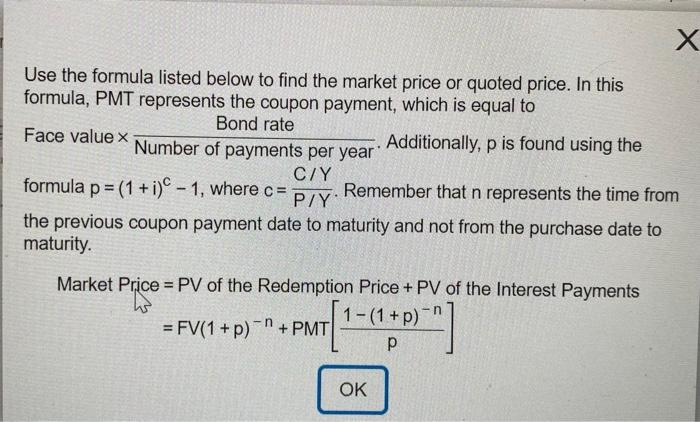

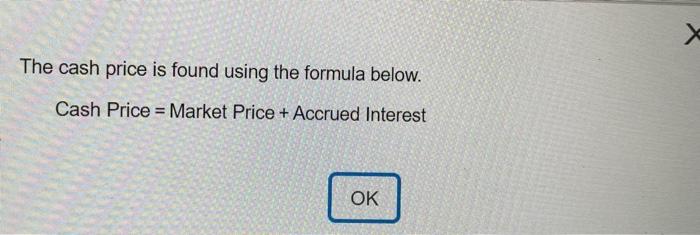

Nine $1000 bonds with 7.4% coupons payable semi-annually are purchased three months after a coupon matures, to yield 3.7% compounded annually. The bonds mature in ten years. (a) What is the market price or quoted price of the bonds? (b) What is the accrued interest? (c) What is the cash price? (a) The quoted price of the bonds is $. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The accrued interest is equal to $ (Round to the nearest cent as needed.) (c) The cash price is $. (Round to the nearest cent as needed.) X Use the formula listed below to find the market price or quoted price. In this formula, PMT represents the coupon payment, which is equal to Bond rate Face value x Number of payments per year. Additionally, p is found using the C/Y formula p = (1 + i) - 1, where c= P/Y Remember that n represents the time from the previous coupon payment date to maturity and not from the purchase date to maturity. Market Price = PV of the Redemption Price + PV of the Interest Payments 1-(1 + p) = FV(1 + p) -" + PMT 1 **** OK X The cash price is found using the formula below. Cash Price = Market Price + Accrued Interest OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts