Question: The second question please. 1. Given the free cash flow to firm below, WACC is 10%. What is MIRR of this project? (Hint: you may

The second question please.

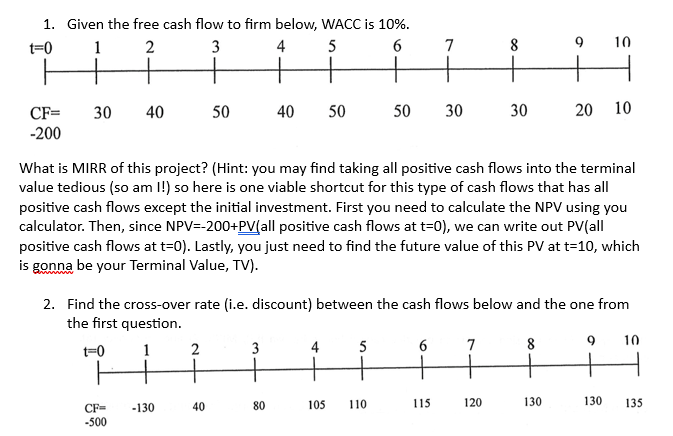

1. Given the free cash flow to firm below, WACC is 10%. What is MIRR of this project? (Hint: you may find taking all positive cash flows into the terminal value tedious (so am I!) so here is one viable shortcut for this type of cash flows that has all positive cash flows except the initial investment. First you need to calculate the NPV using you calculator. Then, since NPV=-200+PV(all positive cash flows at t=0), we can write out PV(all positive cash flows at t=0 ). Lastly, you just need to find the future value of this PV at t=10, which is gonna be your Terminal Value, TV). 2. Find the cross-over rate (i.e. discount) between the cash flows below and the one from the first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts