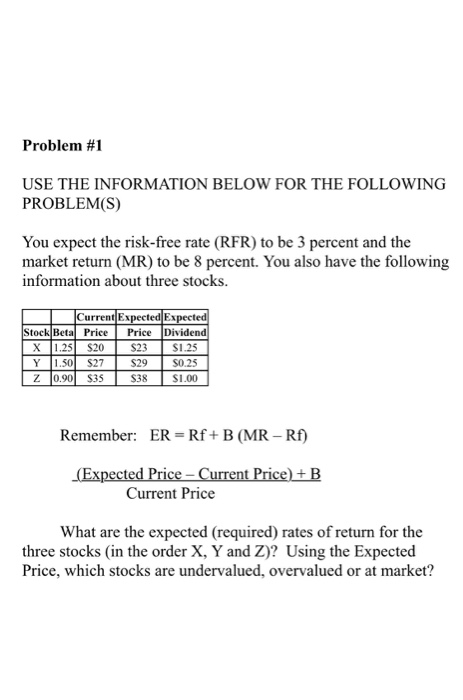

Question: Problem #1 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) You expect the risk-free rate (RFR) to be 3 percent and the market return (MR)

Problem #1 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) You expect the risk-free rate (RFR) to be 3 percent and the market return (MR) to be 8 percent. You also have the following information about three stocks Current Expected Expect Stock Beta Price PriceDividend x 1.25 $20 $23 SI,25 Y 1.50 S27 $29 S0.25 Z 0.90 S35 S38 S1.00 Remember: ER- RfB (MR-Rf) (Expected Price Current Price) B Current Price What are the expected (required) rates of return for the three stocks (in the order X, Y and Z)? Using the Expected Price, which stocks are undervalued, overvalued or at market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts