Question: the second time I sent the task, the first time they prepared it for me but it was incomplete, could someone help me and prepare

the second time I sent the task, the first time they prepared it for me but it was incomplete, could someone help me and prepare it completely please and thank you.

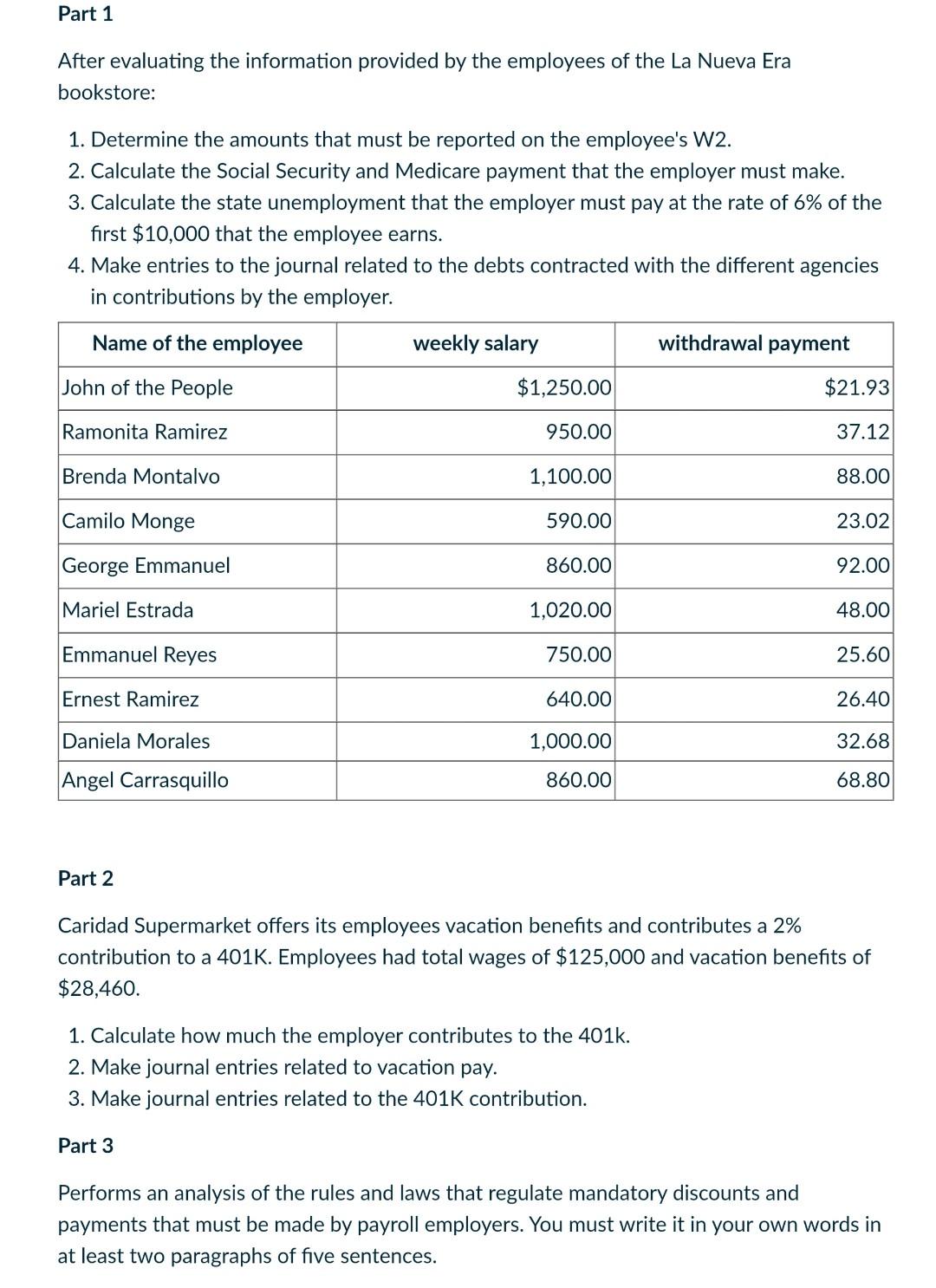

Part 1 After evaluating the information provided by the employees of the La Nueva Era bookstore: 1. Determine the amounts that must be reported on the employee's W2. 2. Calculate the Social Security and Medicare payment that the employer must make. 3. Calculate the state unemployment that the employer must pay at the rate of 6% of the first $10,000 that the employee earns. 4. Make entries to the journal related to the debts contracted with the different agencies in contributions by the employer. Name of the employee John of the People Ramonita Ramirez Brenda Montalvo Camilo Monge George Emmanuel Mariel Estrada Emmanuel Reyes Ernest Ramirez Daniela Morales Angel Carrasquillo Part 2 weekly salary $1,250.00 950.00 1,100.00 590.00 860.00 1,020.00 750.00 640.00 1,000.00 860.00 withdrawal payment 1. Calculate how much the employer contributes to the 401k. 2. Make journal entries related to vacation pay. 3. Make journal entries related to the 401K contribution. Part 3 $21.93 37.12 88.00 23.02 92.00 48.00 25.60 26.40 32.68 68.80 Caridad Supermarket offers its employees vacation benefits and contributes a 2% contribution to a 401K. Employees had total wages of $125,000 and vacation benefits of $28,460. Performs an analysis of the rules and laws that regulate mandatory discounts and payments that must be made by payroll employers. You must write it in your own words in at least two paragraphs of five sentences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts