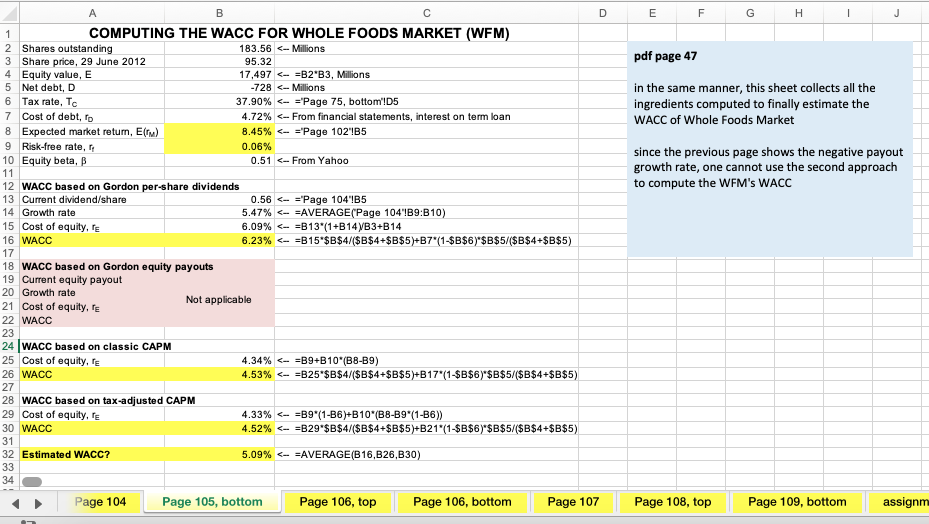

Question: The second WACC calculation based on Gordon equity payouts is not applicable currently because Whole Foods total equity payouts show that in the past 3

The second WACC calculation based on Gordon equity payouts is not applicable currently because Whole Foods total equity payouts show that in the past 3 years the company has absorbed equity from the capital markets (p. 104 of the textbook in detail). Suppose the cost of equity based on the total equity payouts now becomes available and is 9.71%. Using this new cost of equity, compute the second WACC based on Gordon equity payouts.

E F G H 1 J pdf page 47 in the same manner, this sheet collects all the ingredients computed to finally estimate the WACC of Whole Foods Market since the previous page shows the negative payout growth rate, one cannot use the second approach to compute the WFM's WACC B D 1 COMPUTING THE WACC FOR WHOLE FOODS MARKET (WFM) 2 Shares outstanding 183.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts