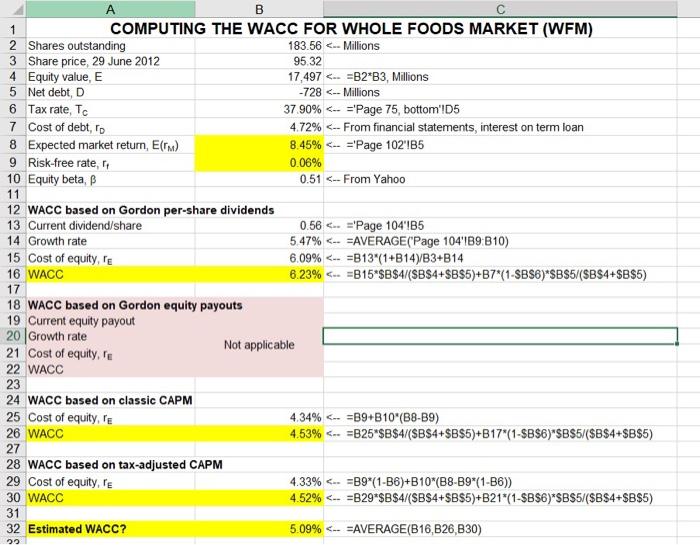

Question: The second WACC calculation based on Gordon equity payouts is not applicable currently because Whole Foods total equity payouts show that in the past 3

The second WACC calculation based on Gordon equity payouts is not applicable currently because Whole Foods total equity payouts show that in the past 3 years the company has absorbed equity from the capital markets. Suppose the cost of equity based on the total equity payouts now becomes available and is 9.71%. Using this new cost of equity, compute the second WACC based on Gordon equity payouts.

B 1 COMPUTING THE WACC FOR WHOLE FOODS MARKET (WFM) 2 Shares outstanding 183.56 <.. millions share price june equity value e net debt d tax rate tc bottom cost of to from financial statements interest on term loan expected market return risk-free beta yahoo wacc based gordon per-share dividends current dividend ..="Page 104" growth eaverage b10 payouts payout not applicable equity. te classic capm le tax-adjusted estimated>

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock