Question: The shops are fully leased at rates ranging from $ 3 6 - $ 5 2 per SF / yr . The average rent is

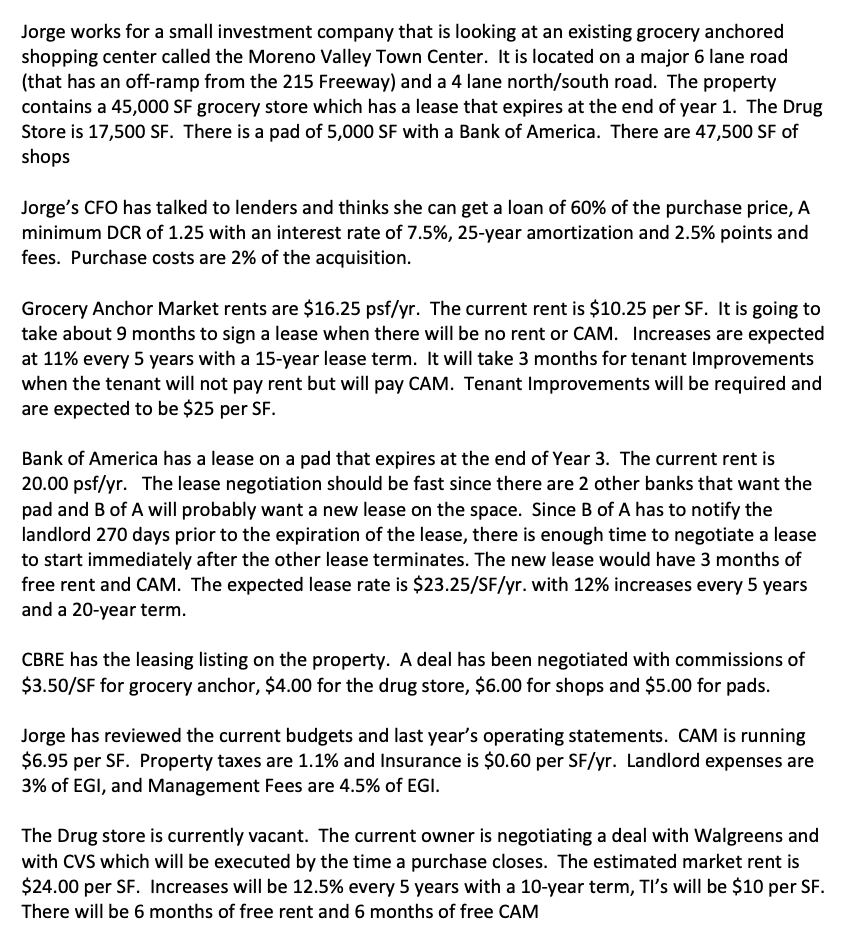

The shops are fully leased at rates ranging from $$ per SFyr The average rent is $ per SF The leases were all signed last year and thus expire at the end of year Rents increase at per year. TIs are about $ per SF Shop leases have a year term. There is significant deferred maintenance on the property which will need to be done in year including a new roof $ termite work $ and broken parking lot lights $ In addition, a new plaza is proposed for the center of the project which will cost $ Since the property is over years old, reserves for replacement are estimated at of EGI. Jorge has analyzed the parking ratio of the center. The site has parking spaces in excess of the SF ratio that the City requires. Jorge wants to convert a portion of the parking lot into a new pad for a SF Corner Bakery which will use up parking spaces. The new pad will need parking spaces. The lease negotiation should be fast since there are several other restaurants that want the pad. The new ground lease would have months of free rent but the tenant would pay CAM. The expected lease rate is $SFyr with increases every years and a year term. There would be TIs to prepare the site for the tenant of $ It is estimated the lease will be signed at purchase but there will be months of vacancy before the lease commences. Jorges company uses a range of collection loss from The collection loss estimate for this property is due to the strong tenant base. The company has a discount rate that is the inflation rate plus the cap rate. The income inflation rate is estimated at with expense inflation of The selling broker has provided a cap rate survey for similar shopping centers that have sold in the mile radius. The estimated cap rate is Sales costs are Jorges boss has asked him to do the following: Prepare an unleveraged spreadsheet that calculates the PGI, EGI, Expenses, NOI and an IRR and NPV for a $ sales price Prepare a loan amortization table and add leverage to the above spreadsheet and calculate a leveraged IRR and NPV Calculate a value of the property with close to a NPV on an unleveraged basis and determine the leveraged IRR and NPV with its own spreadsheet. Prepare a memo with the results of the analysis of the two spreadsheets, the bid price a list of items missing and a recommendation on whether to purchase the property.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock