Question: the size of the effect, assume that U.S. exports decrease by 5% (as a result of changes to foreign output) in one year. What is

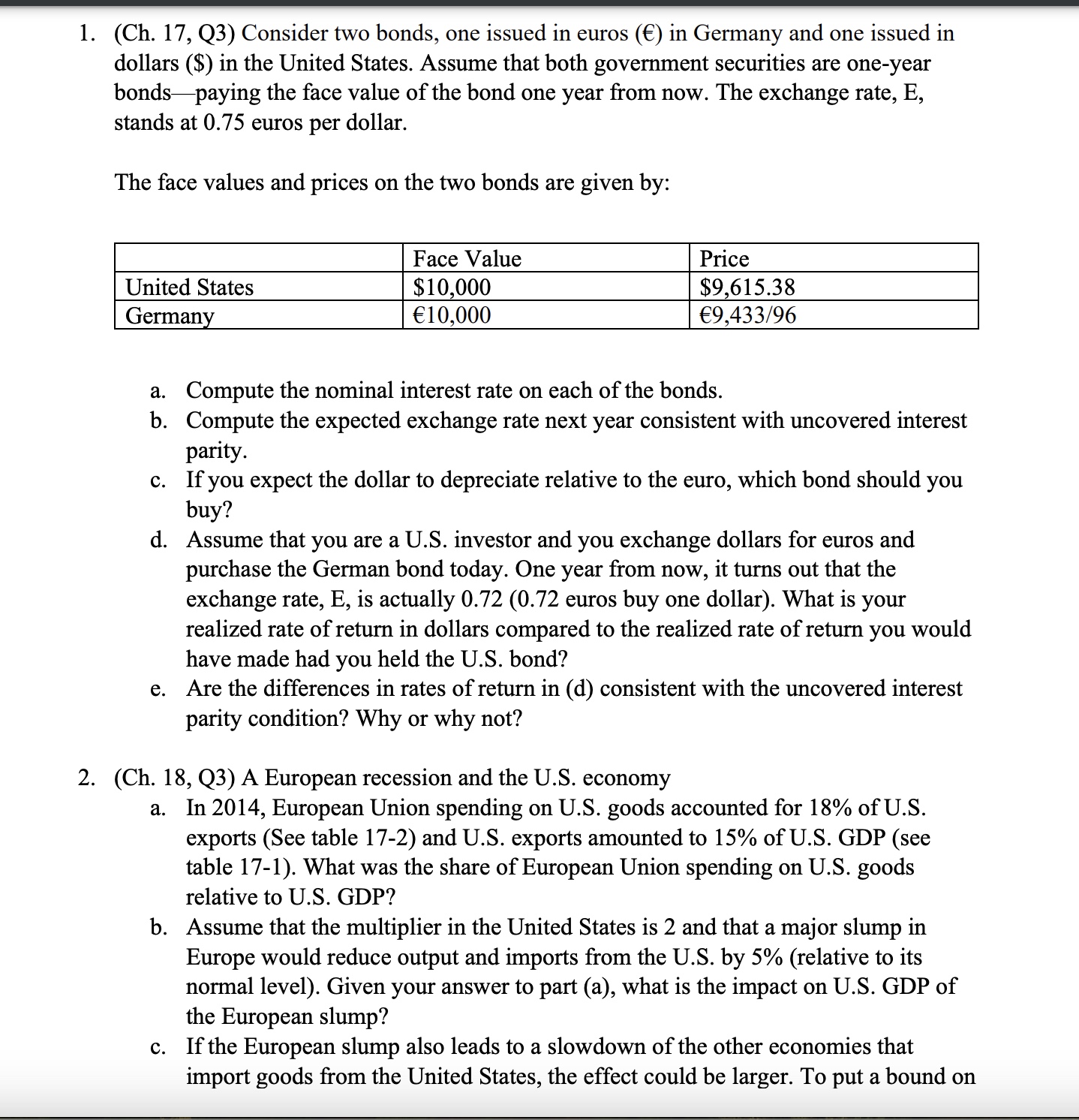

the size of the effect, assume that U.S. exports decrease by 5% (as a result of changes to foreign output) in one year. What is the effect of a 5% drop in exports on U.S. GDP? . Comment on this statement: \"Unless Europe can avoid a major slump following the problems with sovereign debt and the euro, U.S. growth will grind to a halt.\" 1. (Ch. 17, Q3) Consider two bonds, one issued in euros () in Germany and one issued in dollars ($) in the United States. Assume that both government securities are one-year bondspaying the face value of the bond one year from now. The exchange rate, E, stands at 0.75 euros per dollar. The face values and prices on the two bonds are given by: - |Facevalue [ Price | $10,000 $9,615.38 10,000 9,433/96 a. Compute the nominal interest rate on each of the bonds. b. Compute the expected exchange rate next year consistent with uncovered interest parity. c. If you expect the dollar to depreciate relative to the euro, which bond should you buy? d. Assume that you are a U.S. investor and you exchange dollars for euros and purchase the German bond today. One year from now, it turns out that the exchange rate, E, is actually 0.72 (0.72 euros buy one dollar). What is your realized rate of return in dollars compared to the realized rate of return you would have made had you held the U.S. bond? e. Are the differences in rates of return in (d) consistent with the uncovered interest parity condition? Why or why not? 2. (Ch. 18, Q3) A European recession and the U.S. economy a. In 2014, European Union spending on U.S. goods accounted for 18% of U.S. exports (See table 17-2) and U.S. exports amounted to 15% of U.S. GDP (see table 17-1). What was the share of European Union spending on U.S. goods relative to U.S. GDP? b. Assume that the multiplier in the United States is 2 and that a major slump in Europe would reduce output and imports from the U.S. by 5% (relative to its normal level). Given your answer to part (a), what is the impact on U.S. GDP of the European slump? c. Ifthe European slump also leads to a slowdown of the other economies that import goods from the United States, the effect could be larger. To put a bound on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts