Question: The SML shows us that the required return on an asset is equal to the risk-free return plus the risk of the asset, measured by

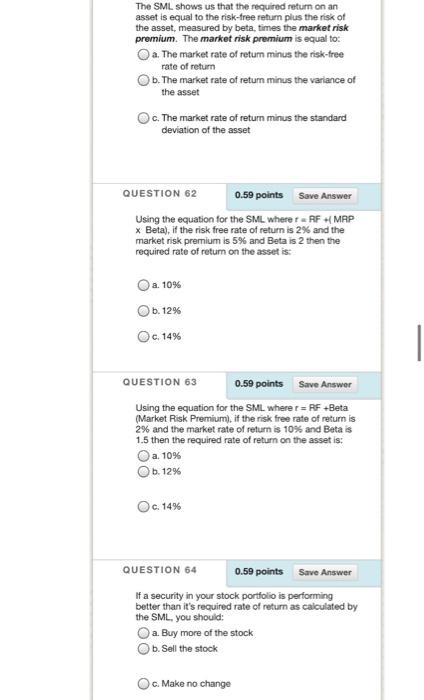

The SML shows us that the required return on an asset is equal to the risk-free return plus the risk of the asset, measured by beta, times the market risk premium. The market risk premium is equal to: a. The market rate of retum minus the risk-free rate of return b. The market rate of return minus the variance of the asset c. The market rate of return minus the standard deviation of the asset QUESTION 62 0.50 points Save Answer Using the equation for the SML where t RF + MRP x Beta), if the risk free rate of return is 2% and the market risk premium is 5% and Beta is 2 then the required rate of return on the asset is: a. 1096 6.12% Oc 14% QUESTION 63 0.59 points Save Answer Using the equation for the SML wherer = RF+Beta (Market Risk Premium), if the risk free rate of return is 2% and the market rate of return is 10% and Beta is 1.5 then the required rate of return on the asset is: Oa 10% b. 12% c. 14% QUESTION 64 0.59 points Save Answer If a security in your stock portfolio is performing better than it's required rate of return as calculated by the SML, you should a. Buy more of the stock b. Sell the stock c. Make no change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts