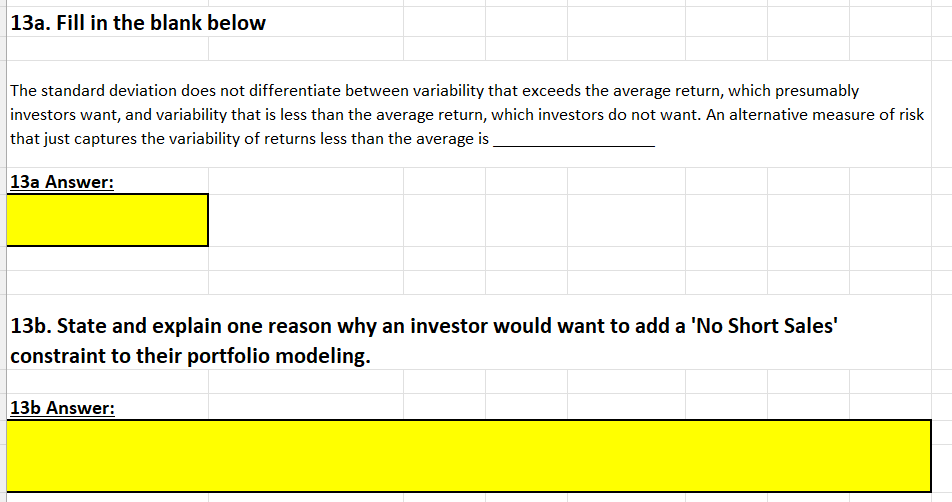

Question: The standard deviation does not differentiate between variability that exceeds the average return, which presumably investors want, and variability that is less than the average

The standard deviation does not differentiate between variability that exceeds the average return, which presumably investors want, and variability that is less than the average return, which investors do not want. An alternative measure of risk that just captures the variability of returns less than the average is 13b. State and explain one reason why an investor would want to add a 'No Short Sales' constraint to their portfolio modeling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts