Question: the steps to getting the correct answers Question 3 1 out of 1 points Determine the upcoming payments on a swap wit, a notional principal

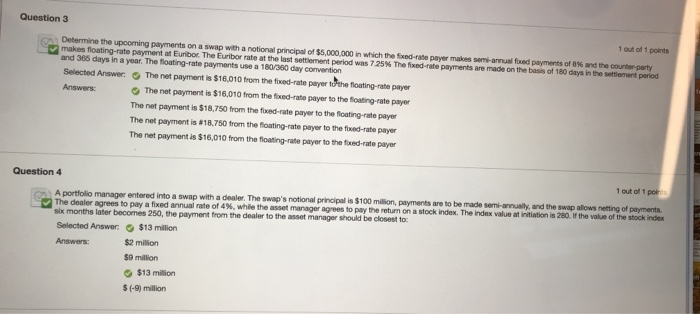

Question 3 1 out of 1 points Determine the upcoming payments on a swap wit, a notional principal of $5,000 000 in which the f Od rate payer makes sentar ual f nd pay wes of 8% a teorte tarty makes floating ate payment at Euribor. The Euribor rate atthe last sett ment period was 725% The fixed ate payments are made on the bass of 18 days ito sette ent perod and 365 days in a year. The floating-rate payments use a 180/360 day convention The net payment is $16,010 from the fixed-ate payer tuwthe foating-rate payer Selected Answer: Answers: The net payment is $16,010 from the fixed-rate payer to the loating-rate payer The net payment is $18,750 from the fixed-rate paryer to the floating-rate payer The net payment is #18,750 trom the floating-rate payer to the fixed-rate payer The net payment is $16,010 from the floating-rate payer to the fxed-rate payer Question 4 1 out of 1 po into a swap with a dealer. The swap's notional principal is $100 million, payments are to be made semi-annually, and the swap allows netting of payments A portfollio manager entered i The dealer agrees to pay a fixed annual rate of 4%, while the asset manager sik months later becomes 250, the payment from the dealer to the asset manager should be closest to Selected Answer:$13 million Answers: $2 million $9 million $13 milion $ (-9) milion Question 3 1 out of 1 points Determine the upcoming payments on a swap wit, a notional principal of $5,000 000 in which the f Od rate payer makes sentar ual f nd pay wes of 8% a teorte tarty makes floating ate payment at Euribor. The Euribor rate atthe last sett ment period was 725% The fixed ate payments are made on the bass of 18 days ito sette ent perod and 365 days in a year. The floating-rate payments use a 180/360 day convention The net payment is $16,010 from the fixed-ate payer tuwthe foating-rate payer Selected Answer: Answers: The net payment is $16,010 from the fixed-rate payer to the loating-rate payer The net payment is $18,750 from the fixed-rate paryer to the floating-rate payer The net payment is #18,750 trom the floating-rate payer to the fixed-rate payer The net payment is $16,010 from the floating-rate payer to the fxed-rate payer Question 4 1 out of 1 po into a swap with a dealer. The swap's notional principal is $100 million, payments are to be made semi-annually, and the swap allows netting of payments A portfollio manager entered i The dealer agrees to pay a fixed annual rate of 4%, while the asset manager sik months later becomes 250, the payment from the dealer to the asset manager should be closest to Selected Answer:$13 million Answers: $2 million $9 million $13 milion $ (-9) milion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts