Question: The subject is Strategic Management. Please do not copy from other websites directly! You are the CEO of a privately owned company. Several of your

The subject is Strategic Management. Please do not copy from other websites directly!

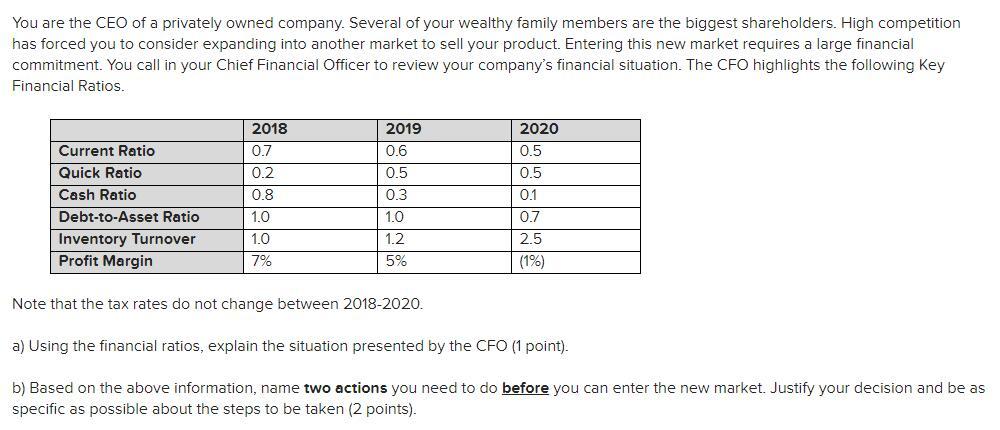

You are the CEO of a privately owned company. Several of your wealthy family members are the biggest shareholders. High competition has forced you to consider expanding into another market to sell your product. Entering this new market requires a large financial commitment. You call in your Chief Financial Officer to review your company's financial situation. The CFO highlights the following key Financial Ratios. Current Ratio Quick Ratio Cash Ratio Debt-to-Asset Ratio Inventory Turnover Profit Margin 2018 0.7 0.2 0.8 1.0 1.0 7% 2019 0.6 0.5 0.3 1.0 1.2 5% 2020 0.5 0.5 0.1 0.7 2.5 (19) Note that the tax rates do not change between 2018-2020. a) Using the financial ratios, explain the situation presented by the CFO (1 point). b) Based on the above information, name two actions you need to do before you can enter the new market. Justify your decision and be as specific as possible about the steps to be taken (2 points). You are the CEO of a privately owned company. Several of your wealthy family members are the biggest shareholders. High competition has forced you to consider expanding into another market to sell your product. Entering this new market requires a large financial commitment. You call in your Chief Financial Officer to review your company's financial situation. The CFO highlights the following key Financial Ratios. Current Ratio Quick Ratio Cash Ratio Debt-to-Asset Ratio Inventory Turnover Profit Margin 2018 0.7 0.2 0.8 1.0 1.0 7% 2019 0.6 0.5 0.3 1.0 1.2 5% 2020 0.5 0.5 0.1 0.7 2.5 (19) Note that the tax rates do not change between 2018-2020. a) Using the financial ratios, explain the situation presented by the CFO (1 point). b) Based on the above information, name two actions you need to do before you can enter the new market. Justify your decision and be as specific as possible about the steps to be taken (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts