Question: The system always shows incomplete, which means I'm missing something in the table. Required information E2-12 Analyzing the Effects of Transactions Using T-Accounts; Preparing and

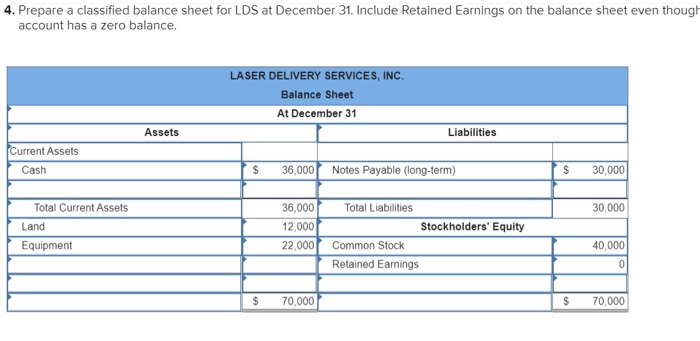

Required information E2-12 Analyzing the Effects of Transactions Using T-Accounts; Preparing and Interpreting a Balance Sheet (LO 2-2, LO 2-3, LO 2-4) (The following information applies to the questions displayed below.) Laser Delivery Services, Inc. (LDS), was incorporated January 1. The following transactions occurred during the year: a. Received $40,000 cash from the company's founders in exchange for common stock. b. Purchased land for $12,000, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $10,000 each; paid $2,000 cash and signed a note due in three years for $18,000 (ignore interest). d. Paid $2,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e Stockholder Jonah Lee paid $300,000 cash for a house for his personal use. E2-12 Part 4 4. Prepare a classified balance sheet for LDS at December 31. Include Retained Earnings on the balance sheet even though the account has a zero balance. 4. Prepare a classified balance sheet for LDS at December 31. Include Retained Earnings on the balance sheet even though account has a zero balance. LASER DELIVERY SERVICES, INC. Balance Sheet At December 31 Assets Liabilities Current Assets Cash $ 36,000 Notes Payable (long-term) $ 30,000 30,000 Total Current Assets Land 36,000 Total Liabilities 12,000 Stockholders' Equity 22,000/ Common Stock Retained Earnings Equipment 40,000 $ 70,000 $ 70,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts