Question: The table above provides us with the partial output from the regression results of Fama-French 3 -Factor model (Fama and French, 1993 ). In order

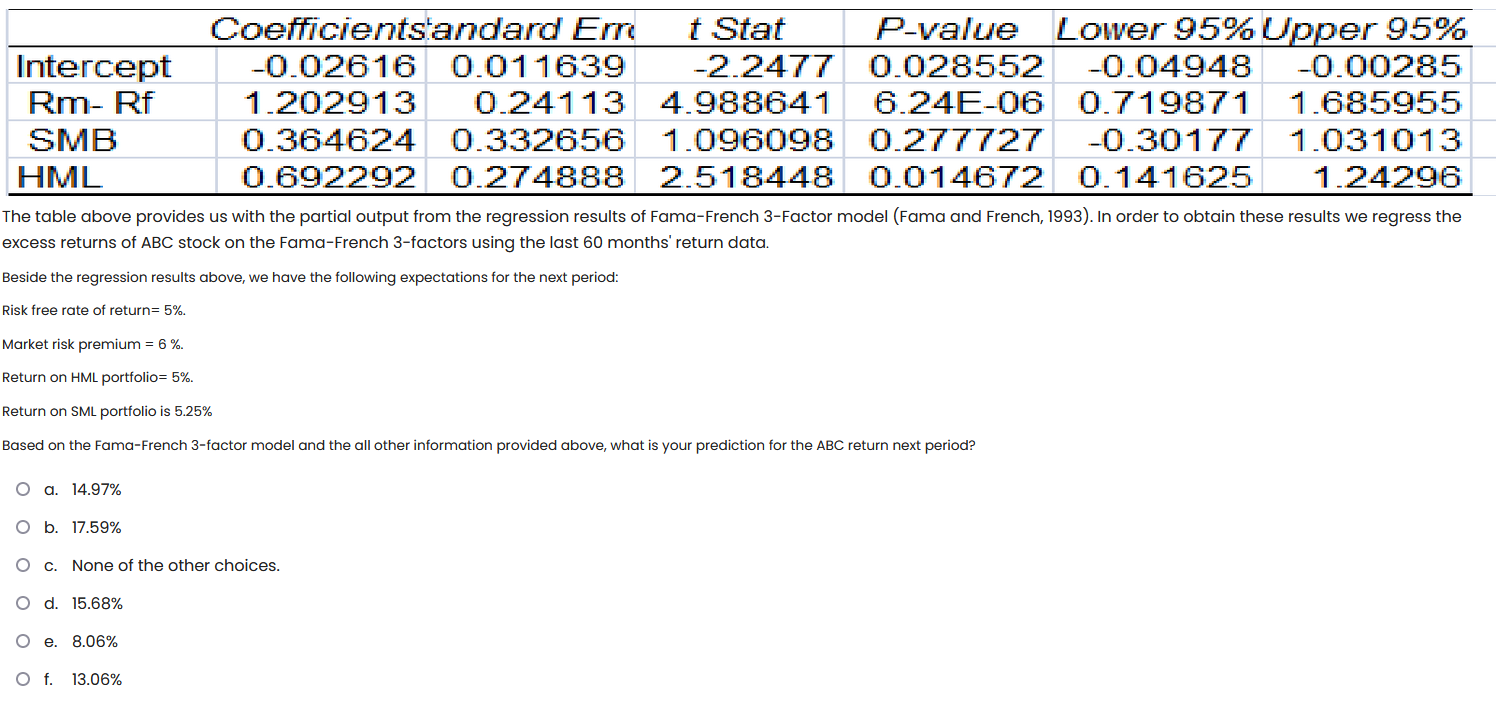

The table above provides us with the partial output from the regression results of Fama-French 3 -Factor model (Fama and French, 1993 ). In order to obtain these results we regress the excess returns of ABC stock on the Fama-French 3 -factors using the last 60 months' return data. Beside the regression results above, we have the following expectations for the next period: Risk free rate of return =5%. Market risk premium =6%. Return on HML portfolio =5%. Return on SML portfolio is 5.25% Based on the Fama-French 3 -factor model and the all other information provided above, what is your prediction for the ABC return next period? a. 14.97% b. 17.59% c. None of the other choices. d. 15.68% e. 8.06% f. 13.06%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts