Question: Intercept Rm-Rf SMB HML Coefficients'andard Em t Stat P-value Lower 95% Upper 95% -0.02616 0.011639 -2.2477 0.028552 -0.04948 -0.00285 1.202913 0.24113 4.988641 6.24E-06 0.719871 1.685955

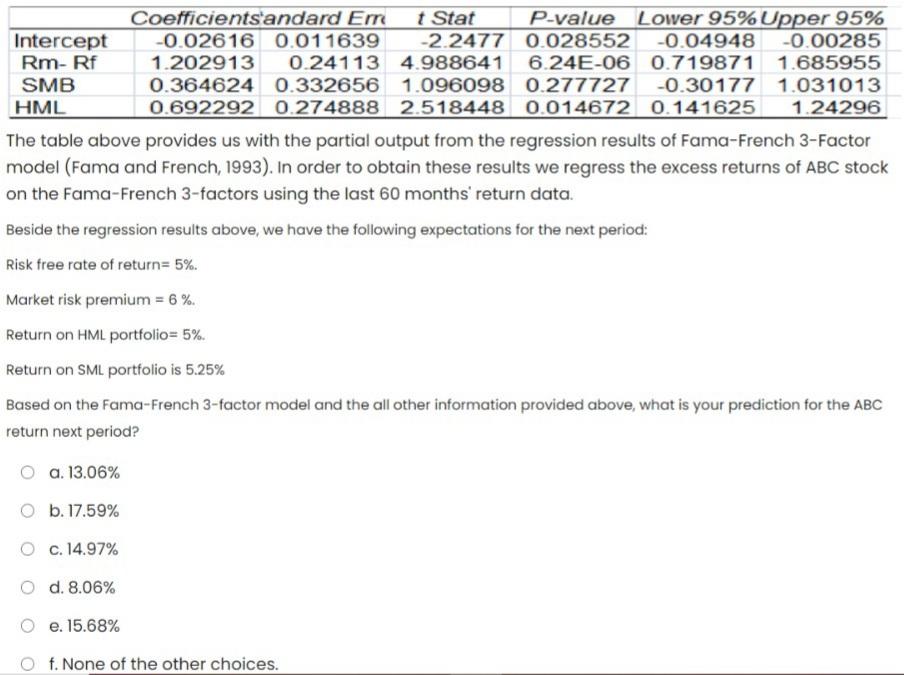

Intercept Rm-Rf SMB HML Coefficients'andard Em t Stat P-value Lower 95% Upper 95% -0.02616 0.011639 -2.2477 0.028552 -0.04948 -0.00285 1.202913 0.24113 4.988641 6.24E-06 0.719871 1.685955 0.364624 0.332656 1.096098 0.277727 -0.30177 1.031013 0.692292 0.274888 2.518448 0.014672 0.141625 1.24296 The table above provides us with the partial output from the regression results of Fama-French 3-Factor model (Fama and French, 1993). In order to obtain these results we regress the excess returns of ABC stock on the Fama-French 3-factors using the last 60 months' return data. Beside the regression results above, we have the following expectations for the next period: Risk free rate of return= 5%. Market risk premium = 6 %. Return on HML portfolio= 5%. Return on SML portfolio is 5.25% Based on the Fama-French 3-factor model and the all other information provided above, what is your prediction for the ABC return next period? a. 13.06% O b. 17.59% O c. 14.97% O d. 8.06% O e. 15.68% Of. None of the other choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts