Question: The Table below contains the current prices for calls and puts at various strike prices. 4. Calculate each option's Intrinsic Value and Time Value. (For

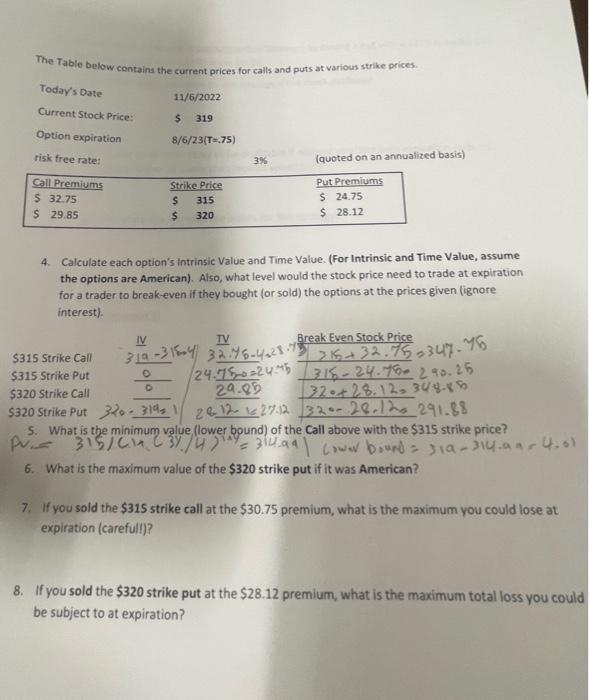

The Table below contains the current prices for calls and puts at various strike prices. 4. Calculate each option's Intrinsic Value and Time Value. (For Intrinsic and Time Value, assume the options are American). Also, what level would the stock price need to trade at expiration for a trader to break-even if they bought (or sold) the options at the prices given (ignore interest). 5. What is the minimum value (lower bound) of the Call above with the $315 strike price? 6. What is the maximum value of the $320 strike put if it was American? 7. If you sold the $315 strike call at the $30.75 premium, what is the maximum you could lose at expiration (carefull)? 8. If you sold the $320 strike put at the $28.12 premium, what is the maximum total loss you could be subject to at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts