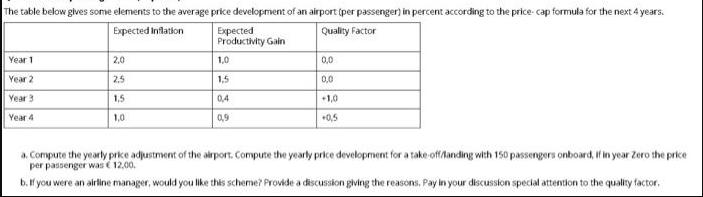

Question: The table below gives some elements to the average price development of an airport (per passenger) in percent according to the price-cap formula for

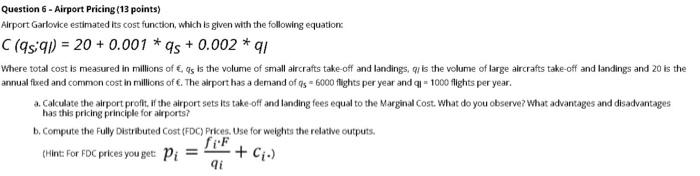

The table below gives some elements to the average price development of an airport (per passenger) in percent according to the price-cap formula for the next 4 years. Expected Inflation Quality Factor Year 1 Year 2 Year 3 Year 4 2,0 2.5 1,5 1,0 Expected Productivity Gain 1,0 1,5 0,4 0,9 0,0 0,0 +0,5 a. Compute the yearly price adjustment of the airport. Compute the yearly price development for a take-off/landing with 150 passengers onboard, if in year Zero the price per passenger was 12,00. b. If you were an airline manager, would you like this scheme? Provide a discussion giving the reasons. Pay in your discussion special attention to the quality factor. Question 6 - Airport Pricing (13 points) Airport Garlovice estimated Its cost function, which is given with the following equation: C (95;91) = 20 + 0.001* qs + 0.002 * ql Where total cost is measured in millions of , qs is the volume of small aircrafts take-off and landings, quis the volume of large aircrafts take-off and landings and 20 is the annual fixed and common cost in millions of . The airport has a demand of qs 6000 flights per year and q- 1000 flights per year. a. Calculate the airport profit, if the airport sets its take-off and landing fees equal to the Marginal Cost. What do you observe? What advantages and disadvantages has this pricing principle for airports? b. Compute the Fully Distributed Cost (FDC) Prices, Use for weights the relative outputs. feF (Hint: For FDC prices you get: Pi = + (.) qi

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

a Compute the yearly price adjustment of the airport and the yearly price development for a takeofflanding with 150 passengers onboard if in year Zero the price per passenger was 1200 Year 1 Yearly pr... View full answer

Get step-by-step solutions from verified subject matter experts