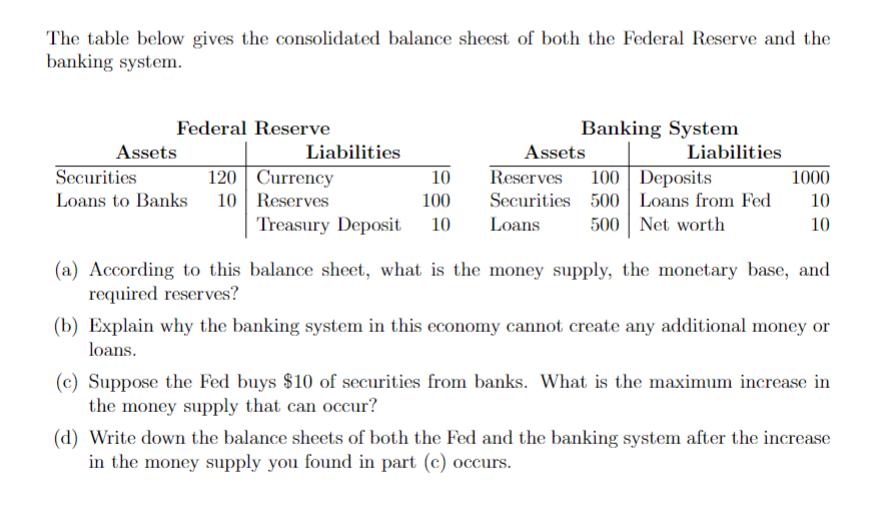

The table below gives the consolidated balance sheest of both the Federal Reserve and the banking...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

The table below gives the consolidated balance sheest of both the Federal Reserve and the banking system. Federal Reserve Assets Liabilities Securities 120 Currency Loans to Banks 10 Reserves Banking System Assets Reserves 100 Deposits Securities 500 Loans from Fed 500 Net worth 10 100 Treasury Deposit 10 Loans Liabilities 1000 10 10 (a) According to this balance sheet, what is the money supply, the monetary base, and required reserves? (b) Explain why the banking system in this economy cannot create any additional money or loans. (c) Suppose the Fed buys $10 of securities from banks. What is the maximum increase in the money supply that can occur? (d) Write down the balance sheets of both the Fed and the banking system after the increase in the money supply you found in part (c) occurs. The table below gives the consolidated balance sheest of both the Federal Reserve and the banking system. Federal Reserve Assets Liabilities Securities 120 Currency Loans to Banks 10 Reserves Banking System Assets Reserves 100 Deposits Securities 500 Loans from Fed 500 Net worth 10 100 Treasury Deposit 10 Loans Liabilities 1000 10 10 (a) According to this balance sheet, what is the money supply, the monetary base, and required reserves? (b) Explain why the banking system in this economy cannot create any additional money or loans. (c) Suppose the Fed buys $10 of securities from banks. What is the maximum increase in the money supply that can occur? (d) Write down the balance sheets of both the Fed and the banking system after the increase in the money supply you found in part (c) occurs.

Expert Answer:

Answer rating: 100% (QA)

a Money supply Currency Deposits 10 500 510 Monetary base Currency Reserves 10 100 110 Required rese... View the full answer

Related Book For

Economics

ISBN: 978-0073375694

18th edition

Authors: Campbell R. McConnell, Stanley L. Brue, Sean M. Flynn

Posted Date:

Students also viewed these accounting questions

-

Explain why total financial assets in the economy must equal total financial liabilities.

-

The table below gives a stock funds quarterly returns for the years 2003 to 2007. Are the results affected by the quarter of the year? Is the variability in the return from year to year statistically...

-

The table below gives data on moisture content for specimens of a certain type of fabric. Determine control limits for a chart with center line at height 13.00 based on Ï = .600, construct the...

-

Magna Jets is a medium sized company that manufactures luxury goods for several well-known chain stores. In real terms, the company has experienced only a small growth in turnover in recent years,...

-

Calculate the amperages in each part of each network. (a) This is a simple network (b) Compare this one with the parallel case discussed above. (c) This is a reasonably complicated network 3 ohm 9...

-

List the decision steps for one of the decisions in your answer to question 1. List the decision steps for one of the decisions in your answer to question 3. Compare the use of information systems to...

-

How many calories in a hot dog? Some people worry about how many calories they consume. Consumer Reports magazine, in a story on hot dogs, measured the calories in 20 brands of beef hot dogs, 17...

-

Here are simplified financial statements for Watervan Corporation: The company's cost of capital is 8.5%. a. Calculate Watervan's economic value added (EVA). b. What is the company's return on...

-

Assume the following information from a schedule of cost of goods manufactured: What is the manufacturing overhead applied to work in process

-

Kennedy Prisby, age 33, is single and has no dependents. Her social security number is 111-22-3333. Her address is 101 North Fork Ave., Cedar City, UT 84720. She has no intention of donating to the...

-

In the lodging industry, room usage and room availability will be forecast by individual room type and total number of guest departures. guest arrivals. rooms blocked. rooms available for sale

-

Explain the memory layout of a C program and discuss how different segments of memory are managed. ?

-

Explain the "volatile" keyword in C. Where and why would you use it?

-

What is the difference between malloc() and Calloc() ?

-

GATE-2024(Electrical Engineering) question. Q.10 A surveyor has to measure the horizontal distance from her position to a distant reference point C. Using her position as the center, a 200 m...

-

The members of a wedding party have approached Imperial Jewelers about buying 2 9 of these gold bracelets for the discounted price of $ 3 6 5 . 0 0 each. The members of the wedding party would like...

-

Make an argument that Williams had a right to delay the closing until after August 1.

-

Indicate whether each of the following statements applies to microeconomics or macroeconomics: a. The unemployment rate in the United States was 4.9 percent in January 2008. b. A U.S. software firm...

-

Very briefly summarize the relationships shown by (a) The consumption schedule, (b) The saving schedule, (c) The investment demand curve, (d) The multiplier effect. Which of these relationships are...

-

Contrast the outcomes of the Standard Oil and U.S. Steel cases. What was the main antitrust issue in the DuPont cellophane case? In what major way do the Microsoft and Standard Oil cases differ?

-

CI9.3. Describe off-balance-sheet financing.

-

C19.1. Explain what a default premium is.

-

CJ9.2. Whatis the objective in reformulating financial statements for credit analysis? How does the reformulation for credit analysis differ from that for equity analysis?

Study smarter with the SolutionInn App