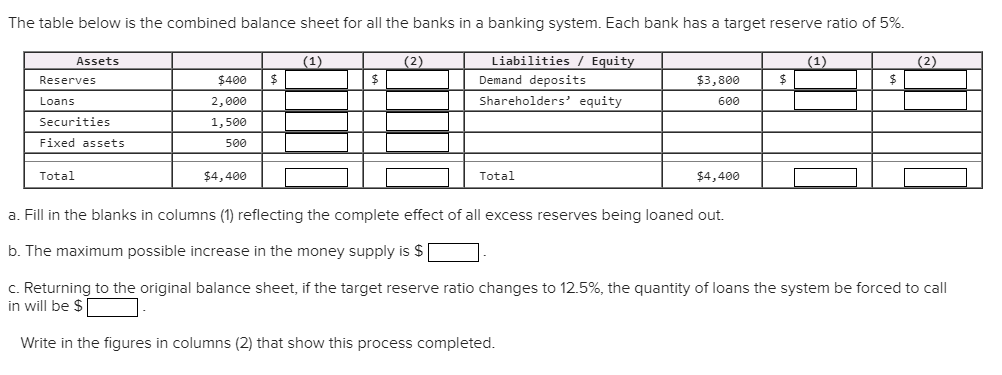

Question: The table below is the combined balance sheet for all the banks in a banking system. Each bank has a target reserve ratio of 5%.

The table below is the combined balance sheet for all the banks in a banking system. Each bank has a target reserve ratio of 5%. Assets (1) (2) (1) (2) $ $ Liabilities Equity Demand deposits Shareholders' equity $ Reserves Loans Securities $ $3,800 600 $400 2,000 1,500 500 Fixed assets Total $4,400 Total $4,400 a. Fill in the blanks in columns (1) reflecting the complete effect of all excess reserves being loaned out. b. The maximum possible increase in the money supply is $ c. Returning to the original balance sheet, if the target reserve ratio changes to 12.5%, the quantity of loans the system be forced to call in will be $ Write in the figures in columns (2) that show this process completed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts