Question: The table below provides information on five call options on different underlying stocks (none of which pays dividends): Call Option Stock Name Time to maturity

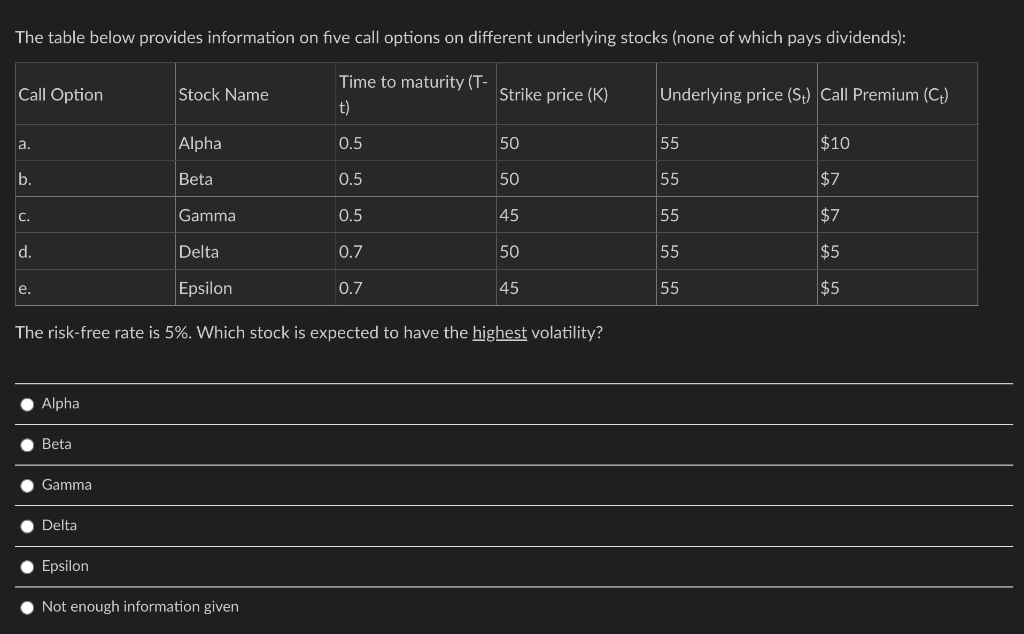

The table below provides information on five call options on different underlying stocks (none of which pays dividends): Call Option Stock Name Time to maturity (T- t) Strike price (K) Underlying price (St) Call Premium (Ct) a. Alpha 0.5 50 55 $10 b. Beta 0.5 50 55 $7 TIT C. Gamma 0.5 45 55 $7 d. Delta 0.7 50 55 $5 e. Epsilon 0.7 45 55 $5 The risk-free rate is 5%. Which stock is expected to have the highest volatility? Alpha Beta Gamma Delta Epsilon Not enough information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts