Question: The table below reports the expected returns and standard deviations of two stocks, as well as their weights in the optimal risky portfolio. The returns

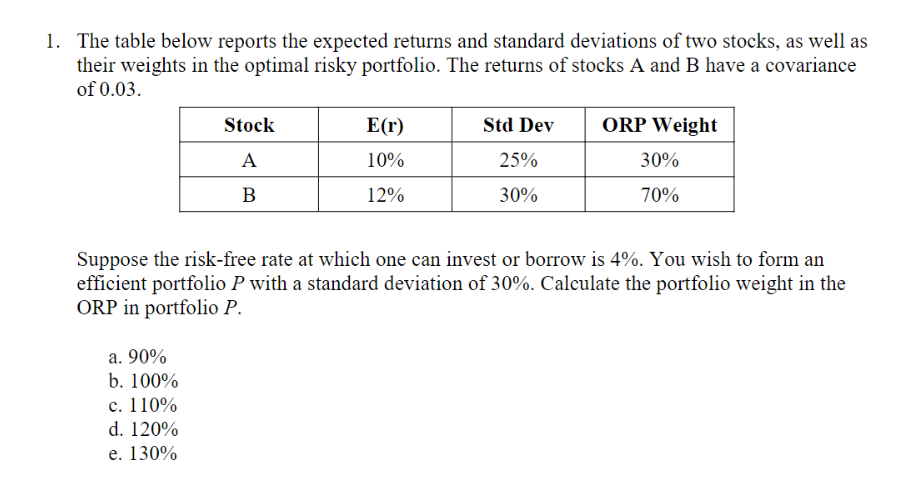

The table below reports the expected returns and standard deviations of two stocks, as well as their weights in the optimal risky portfolio. The returns of stocks A and B have a covariance of 0.03. Suppose the risk-free rate at which one can invest or borrow is 4%. You wish to form an efficient portfolio P with a standard deviation of 30%. Calculate the portfolio weight in the ORP in portfolio P. a. 90% b. 100% c. 110% d. 120% e. 130%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts