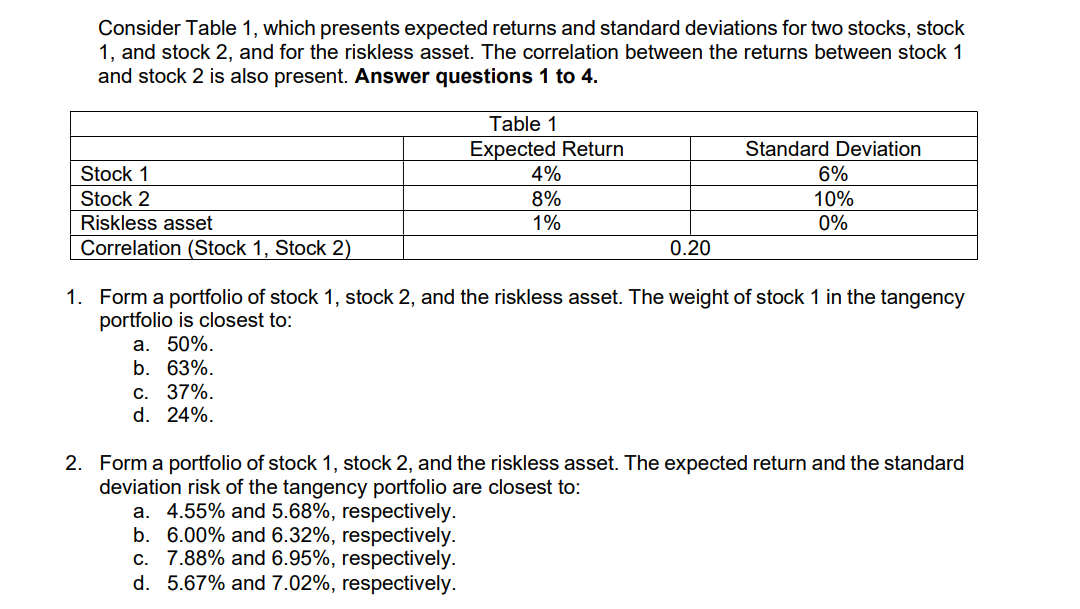

Question: Consider Table 1 , which presents expected returns and standard deviations for two stocks, stock 1 , and stock 2 , and for the riskless

Consider Table which presents expected returns and standard deviations for two stocks, stock

and stock and for the riskless asset. The correlation between the returns between stock

and stock is also present. Answer questions to

Form a portfolio of stock stock and the riskless asset. The weight of stock in the tangency

portfolio is closest to:

a

b

c

d

Form a portfolio of stock stock and the riskless asset. The expected return and the standard

deviation risk of the tangency portfolio are closest to:

a and respectively.

b and respectively.

c and respectively.

d and respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock