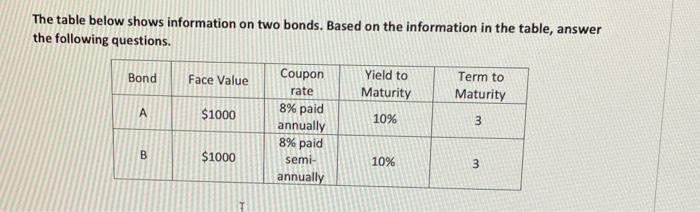

Question: The table below shows information on two bonds. Based on the information in the table, answer the following questions. Bond Face Value Coupon Yield to

The table below shows information on two bonds. Based on the information in the table, answer the following questions. Bond Face Value Coupon Yield to Maturity Term to Maturity rate 8% paid A $1000 10% 3 annually 8% paid B $1000 10% semi- annually i. Calculate bond price for bond A and B. Show all calculations. II. Explain why are the bond prices for A and B different or the same? Explain your answer clearly. I Ancuter. The hand re

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts