Question: The table below shows market prices for four zero coupon bonds with four different terms: one, two, three and four years. The bonds all have

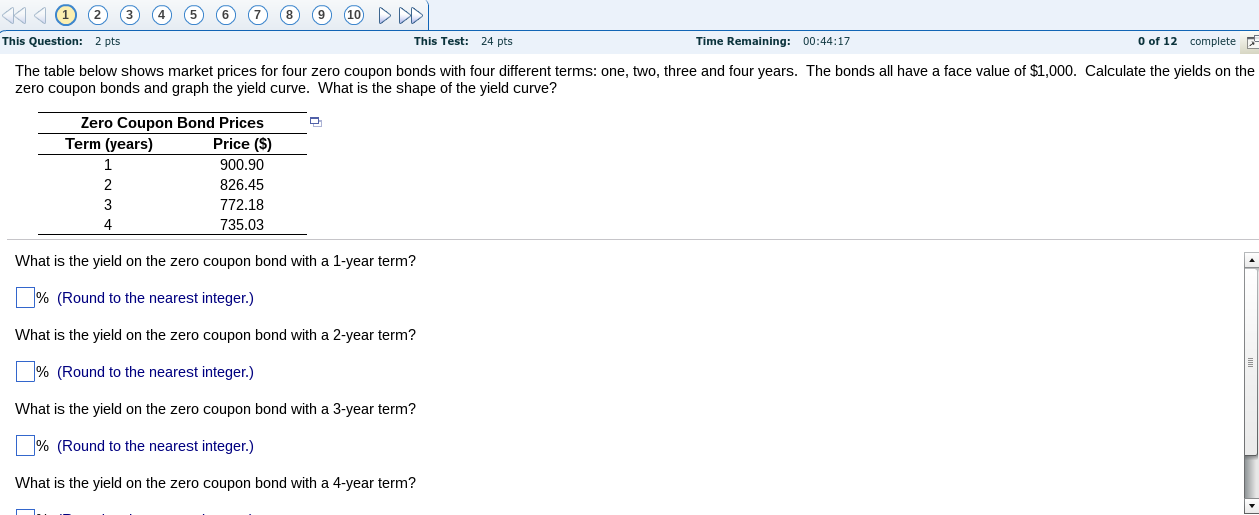

The table below shows market prices for four zero coupon bonds with four different terms: one, two, three and four years. The bonds all have a face value of $1,000. Calculate the yields on the zero coupon bonds and graph the yield curve. What is the shape of the yield curve? What is the yield on the zero coupon bound with a 1-year term? % (Round the nearest integer.) What is the yield on the zero coupon bond with a 2-year term? % (Round the nearest integer.) What is the yield on the zero coupon bond with a 3-year term? % (Round the nearest integer.) What is the yield on the zero coupon bond with a 4-year term

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock