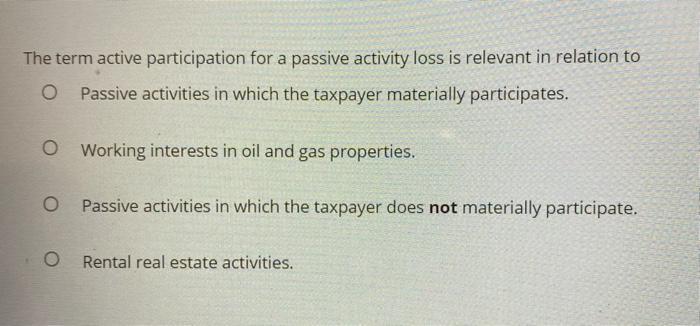

Question: The term active participation for a passive activity loss is relevant in relation to Passive activities in which the taxpayer materially participates. O Working

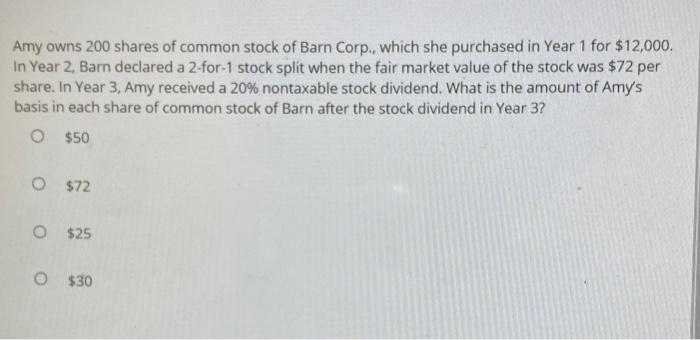

The term active participation for a passive activity loss is relevant in relation to Passive activities in which the taxpayer materially participates. O Working interests in oil and gas properties. O Passive activities in which the taxpayer does not materially participate. Rental real estate activities. Amy owns 200 shares of common stock of Barn Corp., which she purchased in Year 1 for $12,000. In Year 2, Barn declared a 2-for-1 stock split when the fair market value of the stock was $72 per share. In Year 3, Amy received a 20% nontaxable stock dividend. What is the amount of Amy's basis in each share of common stock of Barn after the stock dividend in Year 3? O $50 O $72 O $25 O $30

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

1 The correct answer is Rental real estate activit... View full answer

Get step-by-step solutions from verified subject matter experts