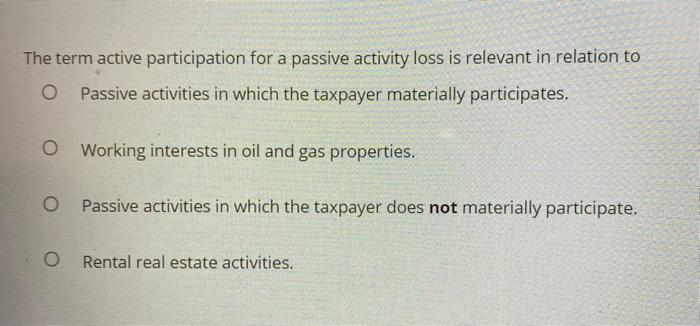

Question: The term active participation for a passive activity loss is relevant in relation to O Passive activities in which the taxpayer materially participates, o Working

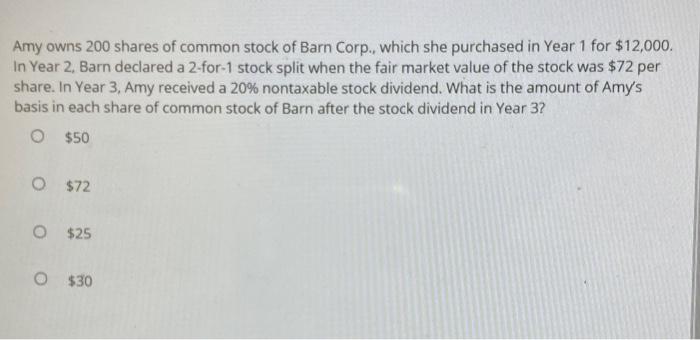

The term active participation for a passive activity loss is relevant in relation to O Passive activities in which the taxpayer materially participates, o Working interests in oil and gas properties. O Passive activities in which the taxpayer does not materially participate. O Rental real estate activities. Amy owns 200 shares of common stock of Barn Corp., which she purchased in Year 1 for $12,000. In Year 2, Barn declared a 2-for-1 stock split when the fair market value of the stock was $72 per share. In Year 3, Amy received a 20% nontaxable stock dividend. What is the amount of Amy's basis in each share of common stock of Barn after the stock dividend in Year 3? O $50 O $72 O $25 O $30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts