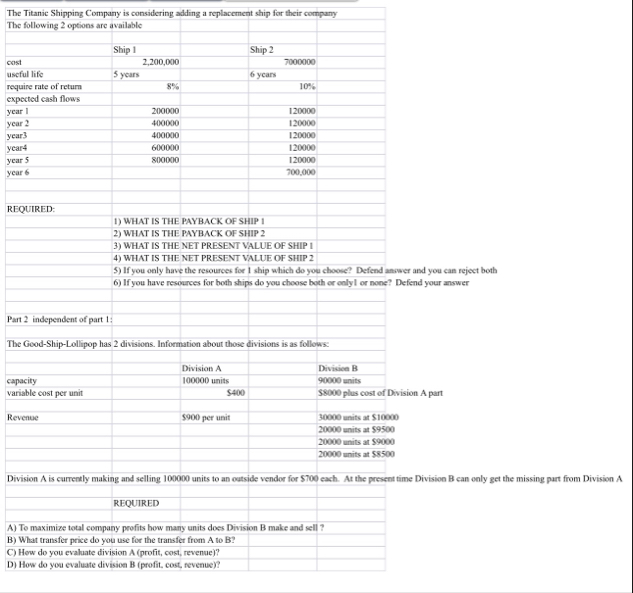

Question: The Titanic Shipping Company is considering adding a replacement ship for their companyThe following 2 options are availableShip 1 5 yearsShip 2 6 yearscost useful

The Titanic Shipping Company is considering adding a replacement ship for their companyThe following options are availableShip yearsShip yearscost useful liferequire rate of return expected cash flows year year year yearyear year REQUIRED: WHAT IS THE PAYBACK OF SHIP WHAT IS THE PAYBACK OF SHIP WHAT IS THE NET PRESENT VALUE OF SHIP WHAT IS THE NET PRESENT VALUE OF SHIP If you only have the resources for ship which do you choose? Defend answer and you can reject both If you have resources for both ships do you choose both or onlyl or none? Defend your answerPart independent of part :The GoodShipLollipop has divisions. Information about those divisions is as follows:Division A unitscapacityvariable cost per unit$Division B units$ plus cost of Division A partRevenue$ per unit units at $ units at $ units at $ units at $Division A is currently making and selling units to an outside vendor for $ each. At the present time Division B can only get the missing part from Division AREQUIREDA To maximize total company profits how many units does Division B make and sell B What transfer price do you use for the transfer from A to BC How do you evaluate division A profit cost revenueD How do you evaluate division B profit cost revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock